The global financial and economic crisis

High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing

All we have is this small scale scapegoat jailing. All the big fish criminals from large WS banks are still at large and in charge.

High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing

U.S. Attorney’s Office

October 02, 2014

Northern District of Illinois(312) 353-5300

CHICAGO—In the first federal prosecution of its kind, a high-frequency trader was indicted for allegedly manipulating commodities futures prices and illegally profiting nearly $1.6 million as a result of trading orders he placed through CME Group and European futures markets in 2011. The defendant, Michael Coscia, was the manager and sole owner of the former Panther Energy Trading LLC, of Red Bank, N.J., which he formed in 2007.

Coscia, 52, of Rumson, N.J., a registered commodities trader since 1988, was charged with six counts of commodities fraud and six counts of “spoofing” in a 12-count indictment returned yesterday by a federal grand jury, Zachary T. Fardon, United States Attorney for the Northern District of Illinois, and Robert J. Holley, Special Agent-in-Charge of the Chicago Office of the Federal Bureau of Investigation, announced today.

The indictment marks the first federal prosecution nationwide under the anti-spoofing provision that was added to the Commodity Exchange Act by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act.

Coscia will be arraigned on a date to be determined in U.S. District Court in Chicago.

“Traders and investors deserve a level playing field, and when the field is tilted by market manipulators, regardless of their speed or sophistication, we will prosecute criminal violations to help ensure fairness and restore market integrity,” Mr. Fardon said. “This case reflects the reasons why, earlier this year, we established a Securities and Commodities Fraud Section, which is dedicated to protecting markets and preserving investors’ confidence,” he added.

According to the indictment, high-frequency trading is a form of automated trading that uses computer algorithms for decision-making and placing a high volume of trading orders, quotes, or cancelation of orders in milliseconds. Coscia designed two computer programs he allegedly used in 17 different CME Group markets and three different markets on the London-based ICE Futures Europe exchange, including gold, soybean meal, soybean oil, high-grade copper, Euro FX and Pounds FX currency futures, to implement his fraudulent strategy. It was illegal for traders to place orders in the form of “bids” to buy or “offers” to sell a futures contract with the intent to cancel the bid or offer before execution.

Between August and October 2011, Coscia allegedly defrauded participants in the CME Group and ICE Futures Europe markets. In August 2011, Coscia began a high-frequency trading strategy in which he entered large-volume orders that he intended to immediately cancel before they could filled by other traders, the indictment alleges.

Coscia devised this strategy to create a false impression regarding the number of contracts available in the market, and to fraudulently induce other market participants to react to the deceptive market information he created, the indictment states. His strategy moved the markets in a direction favorable to him, enabling him to purchase contracts at prices lower than, or sell contracts at prices higher than, the prices available in the market before he entered and canceled his large-volume orders, it adds. Coscia then allegedly repeated this strategy in the opposite direction to immediately obtain a profit by buying futures contracts at a lower price than he paid for them, or by selling contracts at a higher price than he paid for them. Each such trade allegedly occurred in a matter of milliseconds. As a result of the aggregate of those fraudulent high-frequency trades, Coscia illegally profited approximately $1,592,867 over approximately three months, the indictment alleges.

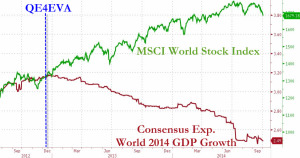

Huge disconnect between overblown stock market bubble and the economies has the IMF worried

•LAGARDE SAYS DISCONNECT BETWEEN MARKETS, ECONOMY ‘QUITE WORRYING’

•LAGARDE SAYS FED’S QE POLICY HAS ‘DONE MUCH TO AID RECOVERY’

•LAGARDE SEES WORRY MARKET, LIQUIDITY RISK MOVING TO ‘SHADOWS’

•LAGARDE: GLOBAL RECOVERY `BRITTLE, UNEVEN AND BESET BY RISKS’

•LAGARDE: WORLD ECONOMY NEEDS BOLD MOVES TO AVOID `NEW MEDIOCRE’

How Goldman Controls The New York Fed: 47.5 Hours Of “The Secret Goldman Sachs Tapes” Explain

When nearly a year ago we reported about the case of “Goldman whistleblower” at the NY Fed, Carmen Segarra, who alleged she was wrongfully terminated after she flagged “numerous conflicts of interest and breaches of client ethics [involving Goldman] that she believed warranted a downgrade of Goldman’s regulatory rating” and which were ignored due to the intimate, and extensively documented on these pages, proximity between Goldman and either one-time NY Fed Chairman and former Goldman director Stephen Friedman or current NY Fed president and former Goldman employee Bill Dudley, we said:

as everyone knows, both Bill Dudley and Stephen Friedman used to be at Goldman, and as we noted Dudley and Goldman chief economist Jan Hatzius periodically did and still meet to discuss “events” at the Pound and Pense.

So while her allegations may be non-definitive, and her wrongfful termination suit is ultimately dropped, there is hope this opens up an inquiry into the close relationship between Goldman and the NY Fed. Alas, since the judicial branch is also under the control of the two abovementioned entities, we very much doubt it.

There was hope, but as we said: we doubted it would lead to much more. It didn’t: in April, the NY Fed won the dismissal of her lawsuit:

U.S. District Judge Ronnie Abrams in Manhattan ruled that the failure by the former examiner, Carmen Segarra, to connect her disclosure of Goldman’s alleged violations to her May 2012 firing was “fatal” to her whistleblower lawsuit. Abrams also said Segarra could not file an amended lawsuit.

“Congress sought to protect employees of banking agencies … who adequately allege that they have suffered retaliation for providing information regarding a possible violation of a ‘law or regulation,'” the judge wrote. “Plaintiff has not done so.”

Segarra’s findings that Goldman’s conflict-of-interest practices may have violated merely an “advisory letter” that did not carry the force of law did not entitle her to whistleblower protection under the Federal Deposit Insurance Act, Abrams said.

Continue here…

Red Adair, the only solution for derivatives market

Myron Scholes, intellectual godfather of the credit default swap, says blow ’em all up

Red Adair put out oil well fires by setting off gigantic explosions at the wellhead. “My belief is that the Fred Adair solution

is to blow up or burn the OTC market in credit default swaps,”

Instead of doing what Scholes, the father of LTCM, suggested, we continued to feed the monster through bailouts, QE1, QE2 lite,

and QE2. Until the outstanding contracts are neutralized, the markets will remain a delayed time bomb waiting to explode

as soon as the Fed stops the flow of liquidity. If the Fed keeps printing and kicking the can down the road, the imbalances

and blowups that follow will only get worse.

It seems nationalization and/or cancellation and strict regulation of these contracts is the only solution, similar to treaties

and nuclear arms agreements between countries with nuclear weapons. These are financial WMD, tied to real dynamic

markets, they should be handled in a similar fashion.

Time for Great Depression has arrived

With the decision of “Operation Twist” by US Federal Reserve to rotate 400 billion dollars

from short maturity T-bills to longer maturities and no new printing, the economic recovery

can no longer be sustained. The Keynesian policymakers are out of bullets as we descend

into post credit bubble economic depression. Operation twist was not what the market

anticipated, the market anticipated QE3. Without further printing or stimulus we anticipate very

rough waters ahead for the economy and the markets. The economic indicators point that a

second recessionhas already started.

I expect that even gold could be vulnerable to a further correction, although, compared to other

indexes it should be mild.

September 2011 Fed Meeting Statement

To support a stronger economic recovery and to help ensure that inflation, over

time, is at levels consistent with the dual mandate, the Committee decided today to extend the

average maturity of its holdings of securities. The Committee intends to purchase, by the end of

June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years

and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less.

This program should put downward pressure on longer-term interest rates and help make

broader financial conditions more accommodative. The Committee will regularly review the size

and composition of its securities holdings and is prepared to adjust those holdings as

appropriate.

Quantitative Easing II postponed, but no drain.

From August, 10 Fed meeting statement:

“To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal

Reserve’s holdings of securities at their current level by reinvesting principal payments from agency debt and agency

mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal

Reserve’s holdings of Treasury securities as they mature. ”

US Federal reserve has 18 billion in Treasury bond coupon passes scheduled for the next 30 days

Formally this means what the Fed has already printed will not be sterilized and will be rotated into treasuries as

MBS on balance sheet mature. The Fed stated they will keep their SOMA account unchanged at $2.054 Trillion.

However, we wonder if the Fed will actually engage in covert printing under the table. One obvious way to do so

happens when the MBS trash on the Fed’s balance sheet defaults. Then there is “double printing”. The first time

was when the Fed actually bought the trash from the banks, the second time when it defaults and the Fed “replaces”

it with treasuries, while keeping it’s SOMA account unchanged.

For example, if ALL MBS trash were to default, the total amount of printing would be a double of what the Fed

allocated to MBS in QEI – the first time printing happened when the Fed bought MBS from banks at face value,

creating money out of thin air to do that. The second time will happen when the trash defaults and the Fed creates

that money AGAIN to buy treasuries.

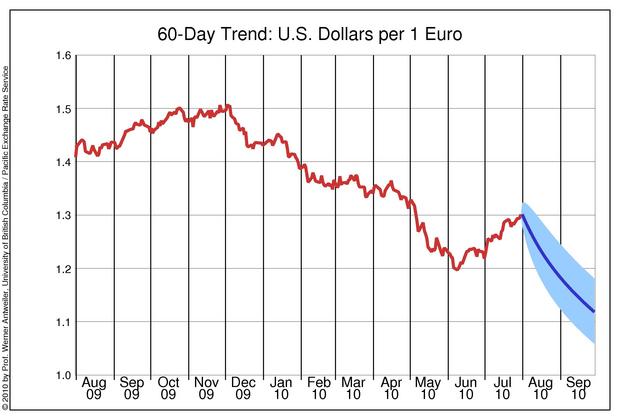

Euro/US dollar pair and SP500

The recent bounce of the Euro led directly to a sharp drop of the dollar index.

This was, perhaps, in part due to the ECB country bailout measures, in part due

to the talk of new Quantitative Easing measures (money printing) by US Federal reserve

due to commence soon. There was much talk, but so far no action, which leaves the

trap door open for a possible disappointment in mid-August, since the Euro

got very overbought. The 60-day regression analysis for Euro/US dollar pair

from UBC is shown below.

This was bullish for equities. A quick note here that the convergence target

for SP500 with inverse USD index moved much higher, to about SP500=900.

Economic depression in various countries

This chart illustrates how bad things are around the globe following financial

crisis. US and UK, while not downgraded yet, are close to the top of the list.

Unemployment and budget deficit in various countries

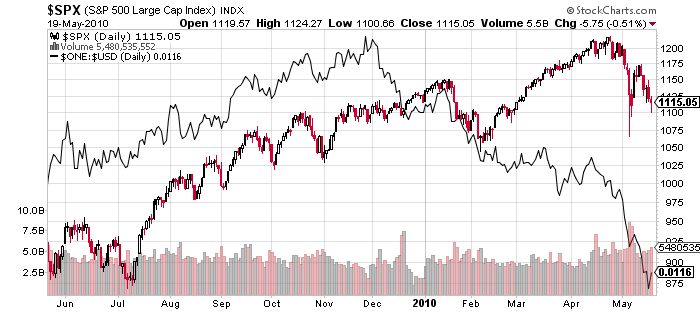

Stocks and dollar update

A huge disconnect developed between SP500 index and the dollar since December

2009, when this was posted. Be careful out there. The tentative

level for SP500 at which USD reconnects with it is 775.

Stocks vs 1/USD

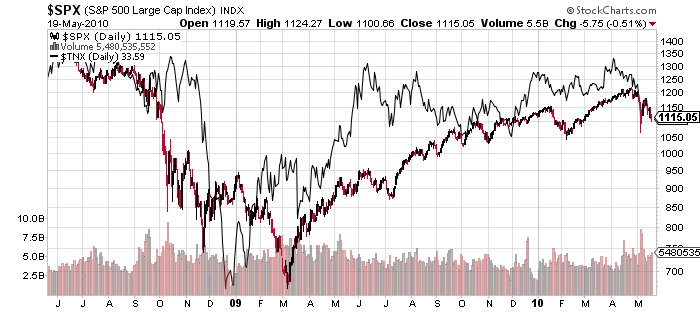

Below is a chart of 10-year interest rates (TNX) vs SP500. As you can see, the

disconnect developed as a result of October 2008 crash. The two later re-connected.

Shortly after October 2008 crash there was a major opportunity to be long T-bonds.

SP500 vs 10-year T-bond interest rate

Two choices: devalue or default

John Hussman clarifies that the European bailout last week was a loan,

not a printing effort. It will be sterilized. This could have direct implications for the

global stock market, as it may continue to head lower. Stay tuned this week,

as technically a follow through to the downside is crucial for the bear case.

We could also be at risk of yet another “flash crash” due to the lack of liquidity

in the global financial system.

Two Choices: Restructure Debts or Debase Currencies

John P. Hussman, Ph.D.

Last week, the European Central Bank pledged to spend as much as 750 billion euros (about a trillion US dollars) in an attempt

to discourage market concerns about European debt, particularly that of Greece, Portugal and Spain. The intended message

was to show the markets – particularly bond market “vigilantes” speculating against European debt – that the ECB has deep

enough pockets to thwart the mounting pressure on European debt and the euro itself.ECB President Jean-Claude Trichet has been quick to deny concerns that the move by the ECB will be inflationary, emphasizing

that the intervention will be “sterilized” in order to prevent a major increase in the amount of euros outstanding. This is “totally

different,” he argued last week, from the massive increase in monetary base that has occurred as the U.S. Federal Reserve has

bought up over $1.25 trillion in debt obligations of Fannie Mae and Freddie Mac. A “sterilized intervention” is one where the

euros created through the purchase of distressed Euro-area debt will also be absorbed by selling other assets from the ECB’s

balance sheet, in order to take those euros back in.In order to evaluate the arguments being made, it’s helpful to understand the balance sheet of a typical central bank. Whether

in the U.S., Europe, or elsewhere, the basic structure is the same. On the asset side, the central bank has government debt

that it has purchased over time. A small proportion of total assets might be held in “hard” assets such as gold, but primarily,

the assets of each central bank has traditionally represented government debt – mostly of its own nation (or in the case of the

ECB, euro-area governments). As a central bank purchases these securities, it creates an equal amount of liabilities, in the

form of “monetary base” (currency and bank reserves).Notice, for example, that the pieces of paper in your wallet have the words “Federal Reserve Note” inscribed at the top.

Currency is a liability of the Federal Reserve, against which it has traditionally held assets such as Treasury securities, and prior

to 1971, at least fractional backing in gold.In this context, consider the ECB’s proposed 750 billion euro line of defense. Essentially the ECB is saying “We stand ready to

buy as much as 750 billion euros of distressed Euro-area debt in order to defend the euro.” Simultaneously, despite the fact

that Euro area countries are running large fiscal deficits, the worst being in Greece, Portugal and Spain, the ECB is saying

“However, we intend to sterilize this intervention, which will ultimately require that we sell Euro-area debt into the market in

order to absorb the euros we create.” The only way that both statements can be true is for the ECB to admit “Therefore, we

are fundamentally promising to debase the quality of our balance sheet, by exchanging higher quality Euro-area debt with

lower-quality debt of countries that are ultimately likely to default.”Far from being “totally different” from what the U.S. Federal Reserve has done, the ECB is essentially promising exactly the

same thing – to corrupt its balance sheet and debase its currency in order to protect the worst stewards of capital from the

consequences of bad lending and poor investment.……………………………………………………………………………………………