Archive for November, 2009

President Jackson, while shutting down the Fed

President Andrew Jackson did not lack courage, he was

a military general. He faced an assasination attempt

for shutting down the Fed, but this is what he had to say about it:

“I too have been a close observer of the doings of the Bank of

the United States. I have had men watching you for a long

time, and am convinced that you have used the funds of the

bank to speculate in the breadstuffs of the country. When you

won, you divided the profits amongst you, and when you lost,

you charged it to the Bank. You tell me that if I take the

deposits from the Bank and annul its charter I shall ruin ten

thousand families. That may be true, gentlemen, but that is

your sin! Should I let you go on, you will ruin fifty thousand

families, and that would be my sin! You are a den of vipers

and thieves. I have determined to rout you out and, by the

Eternal, (bringing his fist down on the table) I will rout you

out. ”

—Andrew Jackson, 1834, on closing the Second Bank of the United States.

U.S. sovereign debt iceberg

The United States is effectively bankrupt, with total obligations exceeding the GDP of the World.

Widely cited for it’s AAA sovereign rating, 12 Trillion national debt is only part of the iceberg.

The bottom, invisible part is much bigger, according to U.S. Department of Treasury.

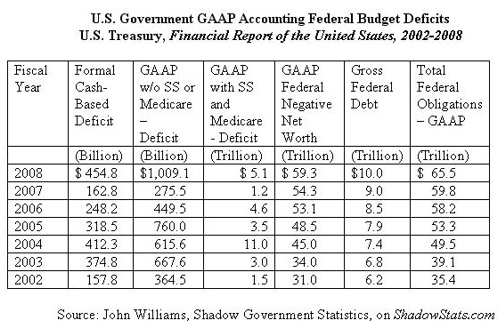

The table below illustrates matters as they were at the end of 2008.

There is no way these obligations can be paid without a major money printing,

major tax hike, a default on Social Security and Medicare, or a combination

of these. The AAA sovereign rating for USA that U.S. credit rating agencies

assign to this country is as much of a lie as their AAA subprime mortgage

debt ratings were. This big lie is still propagated, even as a major 1.725 Trillion printing

effort by U.S. Federal Reserve is currently in process.

US debt iceberg

US deficit and debt, GAAP

Injecting liquidity to inflate the derivative bubble.

It is well known mathematically that liquidity injections cause

volatility to decline. How does it do the job? By inflating the derivative bubble.

This has been our “solution” for every financial mess since 1987 crash.

It has been our “solution” in the Fall of 2008, when TED spread

(spread between 3-month libor and t-bill rates) soared to unimaginable

highs. Why did it soar? Simple, really, as a few large firms went under,

counterparty risk skyrocketed, for which Ted spread is a direct indicator.

While CDS were blamed for the crisis, naturally, these beasts are only a tiny part

of the whole universe. The real values for interest rates contracts skyrocketed

much further. Unlike CDS, however, interest rate swaps are “slow bleeders” –

they don’t bankrupt a firm right away when the bet goes bad, rather, they

cause insolvency and large payments over time.

A little problem here – the derivative Ponzi scheme inflated 10-fold during

the last decade due to these policies and now stands at 10 times the GDP

of the World. Thus, bailing it out in 2008 required enormous liquidity injections.

About 23 Trillion in government guarantees, loans, and direct printing for the US,

or 1.5 times US GDP, by some estimates.

Instead of being the lender of last resort for this Casino, don’t we need to just let

the gamblers go broke and go home, then deal with the economic mess that results?

Yep, we do. But that requires political courage because of incredible mess

the blowup will cause, and that’s not what we did.

BIS derivative report for June 2009 is out.

Highlights? It “worked” yet again

1. Volatility declined.

2. Markets soared as a result.

3. Notional values increased, except for CDS market, where they dropped

4. Real values declined (expected with decline of volatility)

Resume: Derivative bubble, the biggest bubble of them all, inflated again to 605

Trillion dollars notional. Note that this is only a part of the derivative universe.

The other, much smaller part, trades on the exchanges.

Next time the mess will be even bigger.

Key developments:

•notional amounts of all types of OTC contracts rebounded somewhat to stand at $605 trillion at the end of June 2009, 10% above the level six months before,

•gross market values decreased by 21% to $25 trillion,

•gross credit exposures fell by 18% from an end-2008 peak of $4.5 trillion to $3.7 trillion,

•notional amounts of CDS contracts continued to decline, albeit at a slower pace than in the second half of 2008 and

•CDS gross market values shrank by 42%, following an increase of 60% during the previous six-month period.

The “new bull market” – the rally goes bye bye in real terms

Both stocks and bonds are now losing value in real terms due

to the dollar decline. US treasury bonds lost value all year relative

to gold, US stocks started to decline in real terms in August

after a 5-month rally.

SP 500 in gold Oz

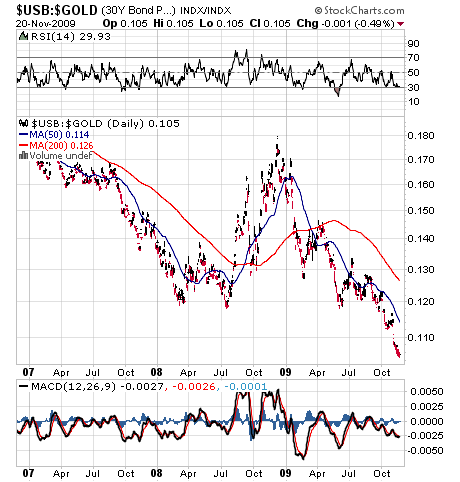

30 year Treasury bond in gold

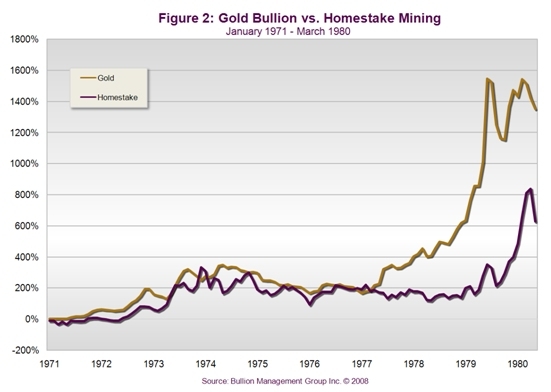

Charts of gold mania: Do equities always lead?

It seems to be a common assumption among precious metals investors that

the equities (GDX, HUI, GDXJ, XAU) always lead gold price. These charts

of the previous mania illustrate that this assumption is not always correct.

You can see below that the stock of Homestake mining and DRD gold did not take off

until the gold mania went into overdrive in 1979-1980. In early 1979 Drooy was

actually DOWN as much as 80% from 1975. The equities did catch up with the metal

in 1979, and then some.

G20 leaves door open for fresh pressure on dollar

By Andrew Torchia – Analysis

LONDON (Reuters) – The U.S. dollar may come under renewed pressure

from emerging market currencies and the euro after a meeting of the world’s top

finance officials failed to take concrete action on rebalancing global money flows.Finance ministers and central bank governors of the Group of 20 major countries,

meeting in Scotland at the weekend, launched a “framework” in which they will

discuss how to reduce trade and savings imbalances between nations.But their communique talked only in general terms about rebalancing economies,

and implied they might not agree on specific policies for individual countries to

adopt before the end of next year at the earliest.The result may be a continuation of heavy fund flows into emerging markets,

boosting currencies there. And central banks intervening to slow currency

appreciation may keep investing much of the money they obtain in the euro,

pushing up that currency too.“We’re probably looking at fresh dollar weakness in the short term” in the

wake of the G20 meeting, said Kenneth Broux, senior markets economist at Lloyds TSB.

Charts predict risk of fully-fledged dollar crisis

Robin Griffiths, technical strategist at Cazenove Capital:

“The dollar trade-weighted is clearly in a downtrend, it does have days when it rallies,

but it’s basically persisting downwards and each potential support level breaks”

“With US interest rates expected to stay near zero for some time, the greenback has

now taken over from the yen’s 20-year reign as the main carry-trade currency”

“What that tells you is that many people wanting to invest anywhere go and borrow some

dollars to do it with. Because they’re institutionalized in the opinion that — by the time

we pay this thing back it will be worth less”

“That’s extremely unhealthy and if this trend goes much further, like taking out the low

of one-year ago … we’ll have a fully fledged dollar crisis and that will knock on across all

markets”

‘I Expect a Currency Crisis or Semi-Crisis’: Jim Rogers

The worst of the economic crisis is not over and a currency crisis can happen this

year or the next year, because the problem of too much debt in the system has not

been solved, legendary investor Jim Rogers told CNBC Monday.The current recovery is just a consequence of the fact that consumption fell so

dramatically in 2008 and people have to buy things they need in 2009, Rogers told

“Worldwide Exchange.”“How can the solution for debt and consumption be more debt and more consumption?

How can that be the solution to our problems?,” he said.Video: Jim Rogers, CEO of Rogers Holdings, told CNBC Monday that when Lehman

Brothers failed he thought “thank goodness they’re finally letting somebody collapse.”“I would expect there to be a currency crisis or a semi-crisis this fall or next year.

It’s crony capitalism, Bernanke and Greenspan have brought crony capitalism to America …

but that’s not going to solve the world’s problems,” Rogers added.There are still “gigantic amounts of horrible, horrible debt that hasn’t been dealt with”

in Central Europe, while hopes that China will pull the world out of recession are overblown,

according to Rogers.“China saved up a lot of money for a rainy day, it’s raining and it’s spending it,”

he said. “But China cannot pull out America or India or Europe from all this. Their

economy is a 10th of the US. Hallelujah, let them do good things but they’re not

going to save the world.”The Federal Reserve has tripled its balance sheet and the US government’s debt

skyrocketed, which may cause currency problems next year, while protectionist

tendencies have already started, he warned.“We’re going to have some serious problems in currency markets, we’re going to

have serious problems in the world markets if we see protectionism rising and rising again,

” he said.

Has gold gone manic?

The NYT article makes a case for a global gold frenzy.

Inside the Global Gold Frenzy

HERE, in a corner of Switzerland where Italian is spoken and roughly one-third

of the world’s gold is refined into bars and ingots, business is booming. Every

day, bangles, bracelets and necklaces arrive in plastic bags — from souks in the

Middle East, from pawn shops in Asia and from corner jewelers in Europe and

North America.“It could be your grandmother’s gold or the gift of an ex-boyfriend,” said Erhard

Oberli, the chief executive of Argor-Heraeus, a major refiner here that processes

roughly 400 tons of gold a year. “Gold doesn’t disappear.”Amid a global frenzy fed by multibillion-dollar hedge funds, wealthy speculators

and governments all rushing to stock up on the precious yellow metal, the price

of gold briefly surpassed $1,100 an ounce on Friday, a record high.Long considered the ultimate refuge for nervous investors, gold has climbed

as the dollar has steadily weakened, budget deficits have expanded in the

United States and Europe, and central banks have continued to pump trillions

of dollars into weak economies, creating fears of another asset bubble that

will ultimately pop.“It’s not that gold has changed, but gold buyers have changed,” said Suki

Cooper, a precious-metals strategist for Barclays Capital. “It’s a structural

shift we’re seeing on the investing side, from Asian central banks right down

to individual investors buying ingots and coins.”……………………………………….

You only need to look at gold supply and demand statistics from World Gold Council

to discover a lie. As you can see, bar hoarding has been roughly equal to buying

gold ETF, which for the most part is GLD. The net assets in GLD are just 35 billion,

much lower than a single large cap stock in the US stock market – say, Apple or

Google, let alone an ASSET CLASS, and that’s accumulated demand since GLD started

to trade, not just 1 year. Given that GLD is rougly equal to bar hoarding, the total

investment demand in gold for the past decade is of the order of 70 billion, or about 0.1% of the

World GDP or global stock market cap. Sure, gold can drop, but it is nowhere

near manic. See ya at $20,000 per Oz!

How did we deal with the Economic depression prior to the Great Depression?

The Panic of 1837

Lecture delivered before the Sunday Lecture Society, May 7, 1876

by John Wentworth

The history of Chicago furnishes one with a complete history of an irredeemable

papermoney system. Emigration was fast tending westward in 1835. Government

land was $1.25 per acre. The emigrants had little or no money, and would purchase

land on credit at greatly advanced prices. Eastern speculators flocked here and took

advantage of this condition of things. The government money received for lands would

be deposited in the banks, credited to the government, and then reloaned back to

speculators. Thus the government had credits in banks to more than the amount of their

capital, and their assets consisted almost entirely of the notes of western speculators.

The government was out of debt, and had no use for its surplus, which was forming the

basis of those large speculative loans, and men became even more excited and reckless

than were the land operators here in Chicago at the time of the recent panic. Besides,

money was taken from every branch of business to invest in these western speculations.

The President of the United States had no power to stop the sales of lands or to limit

bank discounts. He saw the immediate necessity of arresting this condition of things,

and he had no other way to do it than to issue an order that nothing but gold and silver

should be received for the public lands. According to an invariable law, a redundancy of

paper had driven the precious metals out of the country, and the banks had not the

specie wherewith to redeem their bills, which were fast being presented to obtain

land-office money. The banks all failed, and corporations and individuals issued

certificates of indebtedness, which were interchanged as currency. States, counties,

and cities paid their debts in warrants upon an empty treasury. The canal commissioners

paid contractors in scrip, and the contractors paid their laborers in a lesser scrip,

redeemable in the scrip of the commissioners.

Nearly every man in Chicago doing business was issuing his individual scrip, and the city

abounded with little tickets, such as “Good at our store for ten cents,” “Good for a

loaf of bread,” Good for a shave,” “Good for a drink,” etc., etc. When you went out to

trade, the trader would look over your tickets, and select such as he could use to the

best advantage. The times for a while seemed very prosperous. We had a currency that was interchangeable, and for a time we suffered no inconvenience from it, except when we

wanted some specie to pay for our postage. In those days it took 25 cents to send a

letter east.

But after a while it was found out that men were over-issuing. The barber had

outstanding too many shaves; the baker too many loaves of bread; the saloon-keeper

too many drinks, etc., etc. Want of confidence became general. Each man became

afraid to take the tickets of another. Some declined to redeem their tickets in any way,

and some absconded. And people found out, as is always the case where there is a

redundancy of paper money, that they had been extravagant, had bought things they

did not need, and had run in debt for a larger amount than they were able to pay.

Of course, nearly everyone failed, and charged his failure upon President Jackson’s

specie circular. In after times, I asked an old settler, who was a great growler in

those days, what effect time had had upon his views of General Jackson’s circular.

His reply was that General Jackson had spoiled his being a great man. Said he, “I

came to Chicago with nothing, failed for $100,000, and could have failed for a million,

if he had left the bubble burst in the natural way.”

“Reiniscensces of Early Chicago”, The Lakeside Press, Chicago, 1912