Archive for August, 2010

Quantitative Easing II postponed, but no drain.

From August, 10 Fed meeting statement:

“To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal

Reserve’s holdings of securities at their current level by reinvesting principal payments from agency debt and agency

mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal

Reserve’s holdings of Treasury securities as they mature. ”

US Federal reserve has 18 billion in Treasury bond coupon passes scheduled for the next 30 days

Formally this means what the Fed has already printed will not be sterilized and will be rotated into treasuries as

MBS on balance sheet mature. The Fed stated they will keep their SOMA account unchanged at $2.054 Trillion.

However, we wonder if the Fed will actually engage in covert printing under the table. One obvious way to do so

happens when the MBS trash on the Fed’s balance sheet defaults. Then there is “double printing”. The first time

was when the Fed actually bought the trash from the banks, the second time when it defaults and the Fed “replaces”

it with treasuries, while keeping it’s SOMA account unchanged.

For example, if ALL MBS trash were to default, the total amount of printing would be a double of what the Fed

allocated to MBS in QEI – the first time printing happened when the Fed bought MBS from banks at face value,

creating money out of thin air to do that. The second time will happen when the trash defaults and the Fed creates

that money AGAIN to buy treasuries.

Gold seasonals and technicals

Many now argue gold is in a bubble. Indeed, in recent years demand for gold

as an asset went sharply higher. However, if history is an indication, more likely

than not this will result in enormous gains in the years ahead. Gold is going up

for fundamental reasons, Quantitative Easing (money printing) around the world

and in the US in particular.

Jesse repeatedly argued for bullish cup and handle

formation in the gold market, which is not broken while gold stays above 1160.

The pattern has a target of 1375, which will most likely be reached during the bullish

gold season, August through February.

The seasonal chart for gold is below, from 321gold.

Typically gold bottoms in July, goes mildly higher in August, then takes off in September.

The situation was different in 2008, but that, perhaps, happened due to a sharp rally of the dollar.

Gold reached a new all time high in many major currencies in late 2008.

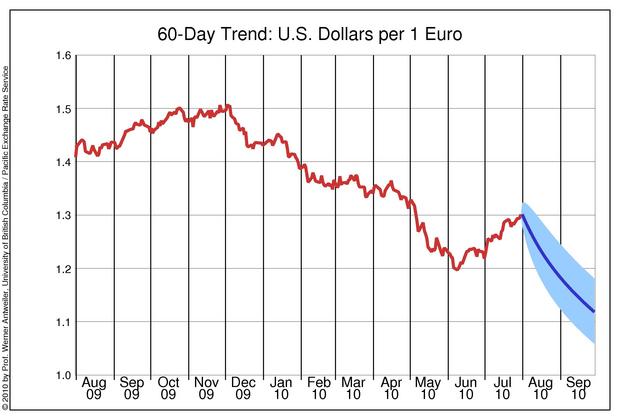

Euro/US dollar pair and SP500

The recent bounce of the Euro led directly to a sharp drop of the dollar index.

This was, perhaps, in part due to the ECB country bailout measures, in part due

to the talk of new Quantitative Easing measures (money printing) by US Federal reserve

due to commence soon. There was much talk, but so far no action, which leaves the

trap door open for a possible disappointment in mid-August, since the Euro

got very overbought. The 60-day regression analysis for Euro/US dollar pair

from UBC is shown below.

This was bullish for equities. A quick note here that the convergence target

for SP500 with inverse USD index moved much higher, to about SP500=900.

Quantitative easing II

WASHINGTON (MNI) – Nomura Friday became the first major firm to formally anticipate a change in Fed

policy as soon as August 10 to alter course toward some renewed quantitative easing, arguing that without the

change, Fed policy is becoming less accommodative week by week.“We think there will be something in the (FOMC) language that maybe reverts back to the language of 2009, around

the first time they made this statement, that the Federal Reserve needs to maintain an expanded balance sheet,”

David Resler, chief North American economist for Normura, told Market News International.“That begs the question, what does that mean to expand,” he continued. “We don’t think they will actively buy

things,” he said, but that they will have to “back up their language.”While the Fed now is committed “only to rolling over guvvies,” he said, “they are becoming less accommodative each

week. Mortgages are not being replaced” and other shrinkage is taking place.“They need to have a strategy for preserving (the balance sheet’s) size. Does that mean they will reinvest paydowns.

I don’t know, and we’re agnostic on how they will do it.”Just lowering rates “is not on the table any more,” he said, and changing the rate of interest on excess reserves “is

the last option they would resort to.” At present “they are losing assets, so I think they would not want to lose them.”

………….

Read more here