US currency crisis

USD/EURO short term trends

Here are 30-day channel and 60-day regression trends for USD/Euro currency pair

The printing press goes overdrive

The wait for QE2 is now over, the Federal reserve announced a new money printing program today.

The Fed will print 600 Billion dollars by the end of June 2011,

which is on top of $30 billion or so printed every month related to their QE lite.

The printing effort will drastically increase monetary base and devalue the currency, the US dollar. While

the short term effect is unclear – the market expected as much as $1-2 Trillion in newly minted dollars,

keep buying precious metals on every dip.

The new printing program is unlikely to help the economy, as inflation so created by the Federal reserve will

push prices of assets not backed by debt far higher than assets backed by debt, such

as houses. Nevertheless, this author expects stock prices to close higher for the year, because in the environment

of rapid devaluation of the currency stocks do better than bonds.

Given recent monetary policy decisions, it appears likely that the Fed will keep printing money until the cows come

home, so be aware that the dollar now has a rapidly vanishing value and invest accordingly.

Gold price target for the year used to be 1455, however, it is unclear how high the metal can soar in this tragic environment.

The Recklessness of Quantitative Easing

October 18, 2010

The Recklessness of Quantitative Easing

John P. Hussman, Ph.D.

With continuing weakness in the U.S. job market, Ben Bernanke confirmed last week what investors have been pricing into the

markets for months – the Federal Reserve will launch a new program of “quantitative easing” (QE), probably as early as

November. Analysts expect that the Fed could purchase $1 trillion or more of U.S. Treasury securities, flooding the financial

system with additional bank reserves.A second round of QE presumably has two operating targets. One is to directly lower long-term interest rates, possibly driving

real interest rates to negative levels in hopes of stimulating loan demand and discouraging saving. The other is to directly

increase the supply of lendable reserves in the banking system. The hope is that these changes will advance the ultimate

objective of increasing U.S. output and employment.

Quantitative easing II

WASHINGTON (MNI) – Nomura Friday became the first major firm to formally anticipate a change in Fed

policy as soon as August 10 to alter course toward some renewed quantitative easing, arguing that without the

change, Fed policy is becoming less accommodative week by week.“We think there will be something in the (FOMC) language that maybe reverts back to the language of 2009, around

the first time they made this statement, that the Federal Reserve needs to maintain an expanded balance sheet,”

David Resler, chief North American economist for Normura, told Market News International.“That begs the question, what does that mean to expand,” he continued. “We don’t think they will actively buy

things,” he said, but that they will have to “back up their language.”While the Fed now is committed “only to rolling over guvvies,” he said, “they are becoming less accommodative each

week. Mortgages are not being replaced” and other shrinkage is taking place.“They need to have a strategy for preserving (the balance sheet’s) size. Does that mean they will reinvest paydowns.

I don’t know, and we’re agnostic on how they will do it.”Just lowering rates “is not on the table any more,” he said, and changing the rate of interest on excess reserves “is

the last option they would resort to.” At present “they are losing assets, so I think they would not want to lose them.”

………….

Read more here

Economic depression in various countries

This chart illustrates how bad things are around the globe following financial

crisis. US and UK, while not downgraded yet, are close to the top of the list.

Unemployment and budget deficit in various countries

Two choices: devalue or default

John Hussman clarifies that the European bailout last week was a loan,

not a printing effort. It will be sterilized. This could have direct implications for the

global stock market, as it may continue to head lower. Stay tuned this week,

as technically a follow through to the downside is crucial for the bear case.

We could also be at risk of yet another “flash crash” due to the lack of liquidity

in the global financial system.

Two Choices: Restructure Debts or Debase Currencies

John P. Hussman, Ph.D.

Last week, the European Central Bank pledged to spend as much as 750 billion euros (about a trillion US dollars) in an attempt

to discourage market concerns about European debt, particularly that of Greece, Portugal and Spain. The intended message

was to show the markets – particularly bond market “vigilantes” speculating against European debt – that the ECB has deep

enough pockets to thwart the mounting pressure on European debt and the euro itself.ECB President Jean-Claude Trichet has been quick to deny concerns that the move by the ECB will be inflationary, emphasizing

that the intervention will be “sterilized” in order to prevent a major increase in the amount of euros outstanding. This is “totally

different,” he argued last week, from the massive increase in monetary base that has occurred as the U.S. Federal Reserve has

bought up over $1.25 trillion in debt obligations of Fannie Mae and Freddie Mac. A “sterilized intervention” is one where the

euros created through the purchase of distressed Euro-area debt will also be absorbed by selling other assets from the ECB’s

balance sheet, in order to take those euros back in.In order to evaluate the arguments being made, it’s helpful to understand the balance sheet of a typical central bank. Whether

in the U.S., Europe, or elsewhere, the basic structure is the same. On the asset side, the central bank has government debt

that it has purchased over time. A small proportion of total assets might be held in “hard” assets such as gold, but primarily,

the assets of each central bank has traditionally represented government debt – mostly of its own nation (or in the case of the

ECB, euro-area governments). As a central bank purchases these securities, it creates an equal amount of liabilities, in the

form of “monetary base” (currency and bank reserves).Notice, for example, that the pieces of paper in your wallet have the words “Federal Reserve Note” inscribed at the top.

Currency is a liability of the Federal Reserve, against which it has traditionally held assets such as Treasury securities, and prior

to 1971, at least fractional backing in gold.In this context, consider the ECB’s proposed 750 billion euro line of defense. Essentially the ECB is saying “We stand ready to

buy as much as 750 billion euros of distressed Euro-area debt in order to defend the euro.” Simultaneously, despite the fact

that Euro area countries are running large fiscal deficits, the worst being in Greece, Portugal and Spain, the ECB is saying

“However, we intend to sterilize this intervention, which will ultimately require that we sell Euro-area debt into the market in

order to absorb the euros we create.” The only way that both statements can be true is for the ECB to admit “Therefore, we

are fundamentally promising to debase the quality of our balance sheet, by exchanging higher quality Euro-area debt with

lower-quality debt of countries that are ultimately likely to default.”Far from being “totally different” from what the U.S. Federal Reserve has done, the ECB is essentially promising exactly the

same thing – to corrupt its balance sheet and debase its currency in order to protect the worst stewards of capital from the

consequences of bad lending and poor investment.……………………………………………………………………………………………

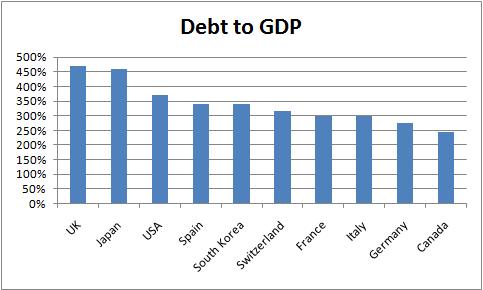

Global debt to GDP ratio

This picture is worth 1000 words. While Sovereign issues in Europe have become

an immediate concern for the global markets, the big offenders are the G7 countries!

The UK, Japan, and the US are at the top of the list.

If the total debt load becomes a concern for the markets, I would expect very

difficult financial conditions.

G7 debt to GDP ratio

How To Play The Coming Dollar Crash

Are funding problems in US housing bubble States such as California, Florida or

Nevada that much different from the problems in Southern Europe? Not

really. However, Sovereign bond ratings are assigned by US credit rating agencies,

which will be reluctant to downgrade US. The crash of the Euro due to PIIGS (Portugal,

Italy, Ireland, Greece, and Spain) blowing up appears to be overdone. Time for

a reversal soon?

Here is the EURUSD COT position

How To Play The Coming Dollar Crash

Curtis Hesler, Professional Timing Service, 04.06.10, 07:10 PM EDT

Last December I headlined my monthly newsletter “How To Play The Dollar Rally.” The short version is that the same technical indicators that were bullish at the end of last year are beginning to transmit bearish omens. There is likely a bit more on the upside for the dollar before it turns, but this final phase of the rally will press precious metals and crude back. It will provide us with a final buying opportunity before the next leg in the commodity bull unfolds.

Here is what is developing. First is sentiment. Everyone on The Street was bearish and was selling the dollar at its late 2009 lows, but there is nothing like a good rally to bring out the bulls. I guess folks just like to buy high and sell low.

There are, of course, those dyed-in-the-wool dollar bears who refuse to recognize the cyclical aspects of the markets. Nevertheless, I am currently seeing more articles espousing a dollar recovery than talk about a return to new lows.

A good number of the dollar bulls are basing their stand on the weakness in the euro. There is some truth to this argument. The euro has been pushed from over 1.50 in early December to about 1.32 lately, and there should be good support at 1.25-1.30.

If you look at the Moving Average Convergence/Divergence (MACD) and Relative Strength Index (RSI) patterns on a chart of the CurrencyShares Euro Trust ( FXE – news – people ) you’ll note that neither the MACD nor the RSI are making new lows with the FXE. MACD is about to produce a second buy signal replete with positive divergence. The positive divergence in the RSI since it bottomed out in February is also telling us to start looking for the end of this decline in the euro.

The euro is setting up for at least a short-term trading rally. I believe fundamentals will support this. Germany is going to orchestrate assistance for Greece without getting personally committed. The Germans will use the crisis to augment their position of power in Europe — something they have not had for many years. Things will appear better in “euroland” soon, and that will give the euro support. As it finds support, dollar traders will begin selling.

The technical omens are present in the dollar also. It is not surprising that the MACD and RSI patterns that we see in the U.S. Dollar Index are the mirror image of those in the FXE chart. Beyond that, the Commodity Channel Index on the weekly dollar is hovering at +100.00, and a break below that will produce a major sell signal. Bottom line, the dollar rally looks like it has a little more life left in it, but not much. It may even venture toward 83.50, but my indicators are telling us to be ready to use a last ditch dollar bounce to our advantage.

The best way to play the next turn in the dollar is to use the last phase of the dollar rally to build positions in precious metals. You need to do this now before the dollar’s top is in. We have a little time, but not much. I expect that the dollar will find its final rally high by the end of this month.

As the precious metals markets pull back in response to a stronger dollar, we will see some magnificent buying opportunities in individual mining shares. I have reviewed the downside buy prices; and by and large, they are where they should be.

See more recommendations and the full article here.

………..

Meltup

This video from inflation.us explains the problems US is currently facing. Is this

the beginning of US currency crisis or hyperinflation? The video is rather long,

but it is a must watch.

Global stock market and sovereign default.

Sovereign defaults present serious risk for the stock market. Overall, stocks in

affected countries decline considerably, and the desease infects the rest of the

Globe. Here is a recent example, the currency crash in Iceland. While US is

much bigger, the problems in the US, the UK, and Southern Europe are all similar.

2008 proved that TBTF (too big to fail) do fail!

Be careful and prepared