US dollar as a reserve currency

Unintended consequences: Sanctions on Russia hurt US dollar dominance

Unintended consequences: Sanctions on Russia hurt US dollar dominance — RT USA

The US dollar, the dominant global currency since 1944, may lose some of its luster due to the American-led sanctions against Russia over the turmoil in Ukraine. The greenback has been fading in favor since the global financial crisis in 2008.

The US-led sanctions against Russia may have backfired on the US because it threatens to “hasten a move away from the dollar that’s been stirring since the global financial crisis [in 2008],” Rachel Evans at Bloomberg wrote. In an unexpected turn of events, Hong Kong’s central bank has bought more than $9.5 billion since the start of July “to prevent its currency from rallying as the sanctions stoked speculation of an influx of Russian cash,” she noted.

“OAO MegaFon, Russia’s second-largest wireless operator, shifted some cash holdings into the city’s dollar,”according to Bloomberg. “Trading of the Chinese yuan versus the Russian ruble rose to the highest on July 31 since the end of 2010, according to the Moscow Exchange.”

In March, after Crimea voted to secede from Ukraine and join Russia, the US and European Union imposed visa restrictions on Russians and Crimeans whom they considered “most directly involved in destabilizing Ukraine, including the military intervention in Crimea.”America and the EU expanded their economic punishment later in the month, as well as twice in April, once in May and twice in July, according to Debevoise & Plimpton, an international financial law firm.

In the latest round of sanctions, issued on July 29, the European Union imposed broader sanctions to “limit access to EU capital markets for Russian State-owned financial institutions, impose an embargo on trade in arms, establish an export ban for dual use goods for military end users and curtail Russian access to sensitive technologies particularly in the field of the oil sector.” President Barack Obama announced the US would also be “blocking the exports of specific goods and technologies to the Russian energy sector,” “expanding sanctions to more banks” and “suspending credit that encourages exports to Russia.”

The dollar’s dominance has shrunk over the last 13 years, from 72 percent of global currency reserves to 61 percent today, threatening the position that the greenback held since the Bretton Woods Conference in July 1944, when delegates from 44 Allied countries met in New Hampshire to hammer out a way to regulate the international monetary and financial order after the conclusion of World War II. Each signatory agreed to adopt a monetary policy that maintained the exchange rate by tying its national currency to the US dollar and to prevent competitive devaluation of its money. At the time, the dollar was pegged to the price of gold. In 1971, President Richard Nixon took the US off the gold standard, and the American banknote became the reserve currency around the world. Certain commodities, like oil, are priced in US dollars, regardless of the country of origin.

“The crisis created a rethink of the dollar-denominated world that we live in,” Joseph Quinlan, chief market strategist at Bank of America Corp.’s US Trust, which oversees about $380 billion, told Evans. “This nasty turn between Russia and the West related to sanctions, that can be an accelerator toward a more multicurrency world.”

The wording of the economic penalties may also negatively impact the greenback’s standing as the world’s reserve currency.

The King Dollar trade

With the USD experiencing its longest stretch of weekly gains since Bretton Woods, it appears, as SocGen notes, that recent currency movements have triggered nostalgia of the pre-crisis world when dollar strength was synonymous with a prosperous global economy. However, given the extreme positioning and potential for policy-maker complacency, SocGen warns the paradox is thus that a strong dollar tantrum could be a more worrying scenario than a Fed tightening tantrum.

More here

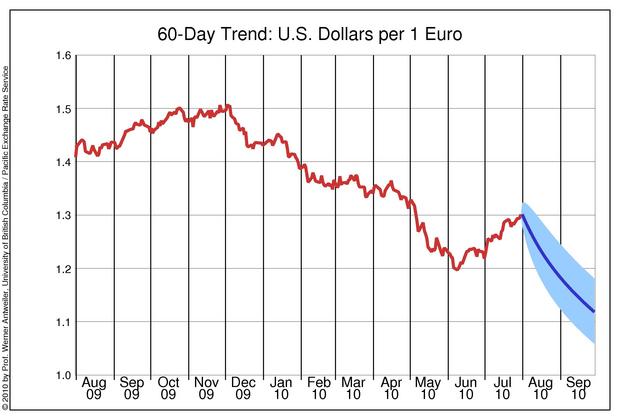

USD/EURO short term trends

Here are 30-day channel and 60-day regression trends for USD/Euro currency pair

Final Q2 GDP surges 4.6%

The good news in the just released final Q2 GDP estimate soared by 4.6%, just as Wall Street expected, which was the biggest quarterly jump since 2011 Q4 2011, driven by gains in business spending, where mandatory forced Obamacare outlays led to a $17.5 billion chained-dollars increase in Healthcare spending to $1815.9 billion. Nonresidential fixed investment contributed two-tenths to the revision, net exports contributed one-tenth, and consumer spending contributed one-tenth. Also helping were corporate profits which rose 8.4% in Q2, the most since Q3 2010, once again courtesy of adjustment in definitions (recall the IVA vs CCAdj change we discussed previously).

The printing press goes overdrive

The wait for QE2 is now over, the Federal reserve announced a new money printing program today.

The Fed will print 600 Billion dollars by the end of June 2011,

which is on top of $30 billion or so printed every month related to their QE lite.

The printing effort will drastically increase monetary base and devalue the currency, the US dollar. While

the short term effect is unclear – the market expected as much as $1-2 Trillion in newly minted dollars,

keep buying precious metals on every dip.

The new printing program is unlikely to help the economy, as inflation so created by the Federal reserve will

push prices of assets not backed by debt far higher than assets backed by debt, such

as houses. Nevertheless, this author expects stock prices to close higher for the year, because in the environment

of rapid devaluation of the currency stocks do better than bonds.

Given recent monetary policy decisions, it appears likely that the Fed will keep printing money until the cows come

home, so be aware that the dollar now has a rapidly vanishing value and invest accordingly.

Gold price target for the year used to be 1455, however, it is unclear how high the metal can soar in this tragic environment.

The Recklessness of Quantitative Easing

October 18, 2010

The Recklessness of Quantitative Easing

John P. Hussman, Ph.D.

With continuing weakness in the U.S. job market, Ben Bernanke confirmed last week what investors have been pricing into the

markets for months – the Federal Reserve will launch a new program of “quantitative easing” (QE), probably as early as

November. Analysts expect that the Fed could purchase $1 trillion or more of U.S. Treasury securities, flooding the financial

system with additional bank reserves.A second round of QE presumably has two operating targets. One is to directly lower long-term interest rates, possibly driving

real interest rates to negative levels in hopes of stimulating loan demand and discouraging saving. The other is to directly

increase the supply of lendable reserves in the banking system. The hope is that these changes will advance the ultimate

objective of increasing U.S. output and employment.

Quantitative Easing II postponed, but no drain.

From August, 10 Fed meeting statement:

“To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal

Reserve’s holdings of securities at their current level by reinvesting principal payments from agency debt and agency

mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal

Reserve’s holdings of Treasury securities as they mature. ”

US Federal reserve has 18 billion in Treasury bond coupon passes scheduled for the next 30 days

Formally this means what the Fed has already printed will not be sterilized and will be rotated into treasuries as

MBS on balance sheet mature. The Fed stated they will keep their SOMA account unchanged at $2.054 Trillion.

However, we wonder if the Fed will actually engage in covert printing under the table. One obvious way to do so

happens when the MBS trash on the Fed’s balance sheet defaults. Then there is “double printing”. The first time

was when the Fed actually bought the trash from the banks, the second time when it defaults and the Fed “replaces”

it with treasuries, while keeping it’s SOMA account unchanged.

For example, if ALL MBS trash were to default, the total amount of printing would be a double of what the Fed

allocated to MBS in QEI – the first time printing happened when the Fed bought MBS from banks at face value,

creating money out of thin air to do that. The second time will happen when the trash defaults and the Fed creates

that money AGAIN to buy treasuries.

Euro/US dollar pair and SP500

The recent bounce of the Euro led directly to a sharp drop of the dollar index.

This was, perhaps, in part due to the ECB country bailout measures, in part due

to the talk of new Quantitative Easing measures (money printing) by US Federal reserve

due to commence soon. There was much talk, but so far no action, which leaves the

trap door open for a possible disappointment in mid-August, since the Euro

got very overbought. The 60-day regression analysis for Euro/US dollar pair

from UBC is shown below.

This was bullish for equities. A quick note here that the convergence target

for SP500 with inverse USD index moved much higher, to about SP500=900.

Quantitative easing II

WASHINGTON (MNI) – Nomura Friday became the first major firm to formally anticipate a change in Fed

policy as soon as August 10 to alter course toward some renewed quantitative easing, arguing that without the

change, Fed policy is becoming less accommodative week by week.“We think there will be something in the (FOMC) language that maybe reverts back to the language of 2009, around

the first time they made this statement, that the Federal Reserve needs to maintain an expanded balance sheet,”

David Resler, chief North American economist for Normura, told Market News International.“That begs the question, what does that mean to expand,” he continued. “We don’t think they will actively buy

things,” he said, but that they will have to “back up their language.”While the Fed now is committed “only to rolling over guvvies,” he said, “they are becoming less accommodative each

week. Mortgages are not being replaced” and other shrinkage is taking place.“They need to have a strategy for preserving (the balance sheet’s) size. Does that mean they will reinvest paydowns.

I don’t know, and we’re agnostic on how they will do it.”Just lowering rates “is not on the table any more,” he said, and changing the rate of interest on excess reserves “is

the last option they would resort to.” At present “they are losing assets, so I think they would not want to lose them.”

………….

Read more here

Economic depression in various countries

This chart illustrates how bad things are around the globe following financial

crisis. US and UK, while not downgraded yet, are close to the top of the list.

Unemployment and budget deficit in various countries