Archive for September, 2014

To US Fed – thank you for saving the gamblers in 2008. They should have been jailed.

We are told there is no bubble, except in gold, of course. Who would want the barbaric relic?

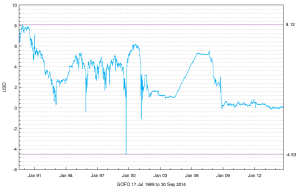

Since 2009 gold price was determined by the gold/dollar swap rate, which fluctuated between plus or minus 0.1%. When this rate was negative 0.1%, meaning that gold yielded 0.1% (per year) more than USD, gold rallied $100. When it was positive, gold tanked $100. Isn’t it amazing that the difference in Yield of a mere 0.1% causes $100, $200 move in price? Isn’t it great to actually be one of the setters of gold interest rates in London? Think about it!

Manipulation of Libor has been the scandal of the recent years. Why not Gofo? But of course!

The King Dollar trade

With the USD experiencing its longest stretch of weekly gains since Bretton Woods, it appears, as SocGen notes, that recent currency movements have triggered nostalgia of the pre-crisis world when dollar strength was synonymous with a prosperous global economy. However, given the extreme positioning and potential for policy-maker complacency, SocGen warns the paradox is thus that a strong dollar tantrum could be a more worrying scenario than a Fed tightening tantrum.

More here

Kitco Gold survey – a great contrarian indicator.

Kitco gold survey has been a great indicator… in reverse. So, this week’s survey is forecasting a strong advance for gold prices in the week ahead.

A majority of participants forecast lower gold prices next week in the Kitco News Gold Survey as dollar strength and bearish technical-chart formations weigh on the metal.

Out of 37 participants, 20 responded this week. Of those, four see higher prices, 12 see lower prices and four see prices trading sideways or are neutral. Market participants include bullion dealers, investment banks, futures traders and technical-chart analysts.

Last week, survey participants were bearish. As of 11:30 a.m. EDT, Comex December gold was down about 50 cents for the week.

Those who see weaker prices said there’s little incentive to buy gold in the short-term, with a test of $1,200 an ounce possible.

“It’s got a bit of a negative profile here,” said Charlie Nedoss, senior market strategist at LaSalle Futures Group. “The dollar is weighing on it. It’s still under the 10-day (moving average), which is about $1,224.80 (basis the December futures). It’s ridden that all the way down. I can’t really start to get excited until it can get over that. And the 20-day is at $1240.21.”

More here

USD/EURO short term trends

Here are 30-day channel and 60-day regression trends for USD/Euro currency pair

Final Q2 GDP surges 4.6%

The good news in the just released final Q2 GDP estimate soared by 4.6%, just as Wall Street expected, which was the biggest quarterly jump since 2011 Q4 2011, driven by gains in business spending, where mandatory forced Obamacare outlays led to a $17.5 billion chained-dollars increase in Healthcare spending to $1815.9 billion. Nonresidential fixed investment contributed two-tenths to the revision, net exports contributed one-tenth, and consumer spending contributed one-tenth. Also helping were corporate profits which rose 8.4% in Q2, the most since Q3 2010, once again courtesy of adjustment in definitions (recall the IVA vs CCAdj change we discussed previously).

How Goldman Controls The New York Fed: 47.5 Hours Of “The Secret Goldman Sachs Tapes” Explain

When nearly a year ago we reported about the case of “Goldman whistleblower” at the NY Fed, Carmen Segarra, who alleged she was wrongfully terminated after she flagged “numerous conflicts of interest and breaches of client ethics [involving Goldman] that she believed warranted a downgrade of Goldman’s regulatory rating” and which were ignored due to the intimate, and extensively documented on these pages, proximity between Goldman and either one-time NY Fed Chairman and former Goldman director Stephen Friedman or current NY Fed president and former Goldman employee Bill Dudley, we said:

as everyone knows, both Bill Dudley and Stephen Friedman used to be at Goldman, and as we noted Dudley and Goldman chief economist Jan Hatzius periodically did and still meet to discuss “events” at the Pound and Pense.

So while her allegations may be non-definitive, and her wrongfful termination suit is ultimately dropped, there is hope this opens up an inquiry into the close relationship between Goldman and the NY Fed. Alas, since the judicial branch is also under the control of the two abovementioned entities, we very much doubt it.

There was hope, but as we said: we doubted it would lead to much more. It didn’t: in April, the NY Fed won the dismissal of her lawsuit:

U.S. District Judge Ronnie Abrams in Manhattan ruled that the failure by the former examiner, Carmen Segarra, to connect her disclosure of Goldman’s alleged violations to her May 2012 firing was “fatal” to her whistleblower lawsuit. Abrams also said Segarra could not file an amended lawsuit.

“Congress sought to protect employees of banking agencies … who adequately allege that they have suffered retaliation for providing information regarding a possible violation of a ‘law or regulation,'” the judge wrote. “Plaintiff has not done so.”

Segarra’s findings that Goldman’s conflict-of-interest practices may have violated merely an “advisory letter” that did not carry the force of law did not entitle her to whistleblower protection under the Federal Deposit Insurance Act, Abrams said.

Continue here…