History

The danger of printing too much money…

The 1993-1994 hyperinflation episode in Yugoslavia has been the worst in modern history.

Between October 1, 1993 and January 24, 1995 prices increased by 5 quadrillion percent. That’s a 5 with 15 zeroes after it.

The Worst Episode of Hyperinflation in History: Yugoslavia 1993-94

Thayer Watkins, Ph.D.

1993 Yugoslav dinar banknote

Under Tito, Yugoslavia ran a budget deficit that was financed by printing money. This led to a rate of inflation of 15 to 25

percent per year. After Tito, the Communist Party pursued progressively more irrational economic policies. These policies and

the breakup of Yugoslavia (Yugoslavia now consists of only Serbia and Montenegro) led to heavier reliance upon printing or

otherwise creating money to finance the operation of the government and the socialist economy. This created the

hyperinflation.

By the early 1990s the government used up all of its own hard currency reserves and proceded to loot the hard currency

savings of private citizens. It did this by imposing more and more difficult restrictions on private citizens’ access to their hard

currency savings in government banks.

The government operated a network of stores at which goods were supposed to be available at artificially low prices. In

practice these store seldom had anything to sell and goods were only available at free markets where the prices were far

above the official prices that goods were supposed to sell at in government stores. All of the government gasoline stations

eventually were closed and gasoline was available only from roadside dealers whose operation consisted of a car parked with a

plastic can of gasoline sitting on the hood. The market price was the equivalent of $8 per gallon. Most car owners gave up

driving and relied upon public transportation. But the Belgrade transit authority (GSP) did not have the funds necessary for

keeping its fleet of 1200 buses operating. Instead it ran fewer than 500 buses. These buses were overcrowded and the ticket

collectors could not get aboard to collect fares. Thus GSP could not collect fares even though it was desperately short of

funds.

Delivery trucks, ambulances, fire trucks and garbage trucks were also short of fuel. The government announced that gasoline

would not be sold to farmers for fall harvests and planting.

Despite the government’s desperate printing of money it still did not have the funds to keep the infrastructure in operation.

Pot holes developed in the streets, elevators stopped functioning, and construction projects were closed down. The

unemployment rate exceeded 30 percent.

The government tried to counter the inflation by imposing price controls. But when inflation continued, the government price

controls made the price producers were getting so ridiculous low that they simply stopped producing. In October of 1993 the

bakers stopped making bread and Belgrade was without bread for a week. The slaughter houses refused to sell meat to the

state stores and this meant meat became unvailable for many sectors of the population. Other stores closed down for

inventory rather than sell their goods at the government mandated prices. When farmers refused to sell to the government at

the artificially low prices the government dictated, government irrationally used hard currency to buy food from foreign sources

rather than remove the price controls. The Ministry of Agriculture also risked creating a famine by selling farmers only 30

percent of the fuel they needed for planting and harvesting.

Later the government tried to curb inflation by requiring stores to file paperwork every time they raised a price. This meant

that many store employees had to devote their time to filling out these government forms. Instead of curbing inflation this

policy actually increased inflation because the stores tended to increase prices by larger increments so they would not have

file forms for another price increase so soon.

In October of 1993 they created a new currency unit. One new dinar was worth one million of the “old” dinars. In effect, the

government simply removed six zeroes from the paper money. This, of course, did not stop the inflation.

In November of 1993 the government postponed turning on the heat in the state apartment buildings in which most of the

population lived. The residents reacted to this by using electrical space heaters which were inefficient and overloaded the

electrical system. The government power company then had to order blackouts to conserve electricity.

In a large psychiatric hospital 87 patients died in November of 1994. The hospital had no heat, there was no food or medicine

and the patients were wandering around naked.

Between October 1, 1993 and January 24, 1995 prices increased by 5 quadrillion percent. This number is a 5 with 15 zeroes

after it. The social structure began to collapse. Thieves robbed hospitals and clinics of scarce pharmaceuticals and then sold

them in front of the same places they robbed. The railway workers went on strike and closed down Yugoslavia’s rail system.

The government set the level of pensions. The pensions were to be paid at the post office but the government did not give

the post offices enough funds to pay these pensions. The pensioners lined up in long lines outside the post office. When the

post office ran out of state funds to pay the pensions the employees would pay the next pensioner in line whatever money

they received when someone came in to mail a letter or package. With inflation being what it was, the value of the pension

would decrease drastically if the pensioners went home and came back the next day. So they waited in line knowing that the

value of their pension payment was decreasing with each minute they had to wait.

Many Yugoslavian businesses refused to take the Yugoslavian currency, and the German Deutsche Mark effectively became the

currency of Yugoslavia. But government organizations, government employees and pensioners still got paid in Yugoslavian

dinars so there was still an active exchange in dinars. On November 12, 1993 the exchange rate was 1 DM = 1 million new

dinars. Thirteen days later the exchange rate was 1 DM = 6.5 million new dinars and by the end of November it was 1 DM = 37

million new dinars.

At the beginning of December the bus workers went on strike because their pay for two weeks was equivalent to only 4 DM

when it cost a family of four 230 DM per month to live. By December 11th the exchange rate was 1 DM = 800 million and on

December 15th it was 1 DM = 3.7 billion new dinars. The average daily rate of inflation was nearly 100 percent. When farmers

selling in the free markets refused to sell food for Yugoslavian dinars the government closed down the free markets. On

December 29 the exchange rate was 1 DM = 950 billion new dinars.

About this time there occurred a tragic incident. As usual, pensioners were waiting in line. Someone passed by the line

carrying bags of groceries from the free market. Two pensioners got so upset at their situation and the sight of someone else

with groceries that they had heart attacks and died right there.

At the end of December the exchange rate was 1 DM = 3 trillion dinars and on January 4, 1994 it was 1 DM = 6 trillion dinars.

On January 6th the government declared that the German Deutsche was an official currency of Yugoslavia. About this time the

government announced a NEW “new” Dinar which was equal to 1 billion of the old “new” dinars. This meant that the exchange

rate was 1 DM = 6,000 new new Dinars. By January 11 the exchange rate had reached a level of 1 DM = 80,000 new new

Dinars. On January 13th the rate was 1 DM = 700,000 new new Dinars and six days later it was 1 DM = 10 million new new

Dinars.

The telephone bills for the government operated phone system were collected by the postmen. People postponed paying these

bills as much as possible and inflation reduced their real value to next to nothing. One postman found that after trying to

collect on 780 phone bills he got nothing so the next day he stayed home and paid all of the phone bills himself for the

equivalent of a few American pennies.

Here is another illustration of the irrationality of the government’s policies: James Lyon, a journalist, made twenty hours of

international telephone calls from Belgrade in December of 1993. The bill for these calls was 1000 new new dinars and it arrived

on January 11th. At the exchange rate for January 11th of 1 DM = 150,000 dinars it would have cost less than one German

pfennig to pay the bill. But the bill was not due until January 17th and by that time the exchange rate reached 1 DM = 30

million dinars. Yet the free market value of those twenty hours of international telephone calls was about $5,000. So despite

being strapped for hard currency, the government gave James Lyon $5,000 worth of phone calls essentially for nothing.

It was against the law to refuse to accept personal checks. Some people wrote personal checks knowing that in the few days

it took for the checks to clear, inflation would wipe out as much as 90 percent of the cost of covering those checks.

On January 24, 1994 the government introduced the “super” Dinar equal to 10 million of the new new Dinars. The Yugoslav

government’s official position was that the hyperinflation occurred “because of the unjustly implemented sanctions against the

Serbian people and state.”

President Jackson, while shutting down the Fed

President Andrew Jackson did not lack courage, he was

a military general. He faced an assasination attempt

for shutting down the Fed, but this is what he had to say about it:

“I too have been a close observer of the doings of the Bank of

the United States. I have had men watching you for a long

time, and am convinced that you have used the funds of the

bank to speculate in the breadstuffs of the country. When you

won, you divided the profits amongst you, and when you lost,

you charged it to the Bank. You tell me that if I take the

deposits from the Bank and annul its charter I shall ruin ten

thousand families. That may be true, gentlemen, but that is

your sin! Should I let you go on, you will ruin fifty thousand

families, and that would be my sin! You are a den of vipers

and thieves. I have determined to rout you out and, by the

Eternal, (bringing his fist down on the table) I will rout you

out. ”

—Andrew Jackson, 1834, on closing the Second Bank of the United States.

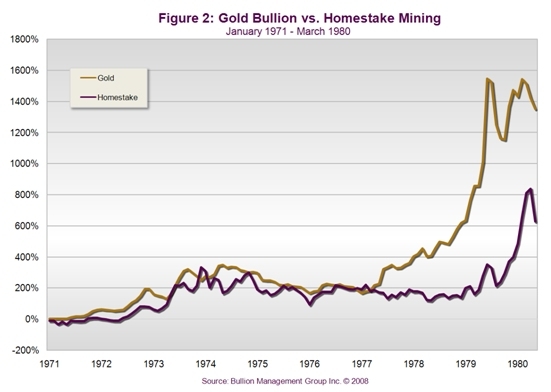

Charts of gold mania: Do equities always lead?

It seems to be a common assumption among precious metals investors that

the equities (GDX, HUI, GDXJ, XAU) always lead gold price. These charts

of the previous mania illustrate that this assumption is not always correct.

You can see below that the stock of Homestake mining and DRD gold did not take off

until the gold mania went into overdrive in 1979-1980. In early 1979 Drooy was

actually DOWN as much as 80% from 1975. The equities did catch up with the metal

in 1979, and then some.

How did we deal with the Economic depression prior to the Great Depression?

The Panic of 1837

Lecture delivered before the Sunday Lecture Society, May 7, 1876

by John Wentworth

The history of Chicago furnishes one with a complete history of an irredeemable

papermoney system. Emigration was fast tending westward in 1835. Government

land was $1.25 per acre. The emigrants had little or no money, and would purchase

land on credit at greatly advanced prices. Eastern speculators flocked here and took

advantage of this condition of things. The government money received for lands would

be deposited in the banks, credited to the government, and then reloaned back to

speculators. Thus the government had credits in banks to more than the amount of their

capital, and their assets consisted almost entirely of the notes of western speculators.

The government was out of debt, and had no use for its surplus, which was forming the

basis of those large speculative loans, and men became even more excited and reckless

than were the land operators here in Chicago at the time of the recent panic. Besides,

money was taken from every branch of business to invest in these western speculations.

The President of the United States had no power to stop the sales of lands or to limit

bank discounts. He saw the immediate necessity of arresting this condition of things,

and he had no other way to do it than to issue an order that nothing but gold and silver

should be received for the public lands. According to an invariable law, a redundancy of

paper had driven the precious metals out of the country, and the banks had not the

specie wherewith to redeem their bills, which were fast being presented to obtain

land-office money. The banks all failed, and corporations and individuals issued

certificates of indebtedness, which were interchanged as currency. States, counties,

and cities paid their debts in warrants upon an empty treasury. The canal commissioners

paid contractors in scrip, and the contractors paid their laborers in a lesser scrip,

redeemable in the scrip of the commissioners.

Nearly every man in Chicago doing business was issuing his individual scrip, and the city

abounded with little tickets, such as “Good at our store for ten cents,” “Good for a

loaf of bread,” Good for a shave,” “Good for a drink,” etc., etc. When you went out to

trade, the trader would look over your tickets, and select such as he could use to the

best advantage. The times for a while seemed very prosperous. We had a currency that was interchangeable, and for a time we suffered no inconvenience from it, except when we

wanted some specie to pay for our postage. In those days it took 25 cents to send a

letter east.

But after a while it was found out that men were over-issuing. The barber had

outstanding too many shaves; the baker too many loaves of bread; the saloon-keeper

too many drinks, etc., etc. Want of confidence became general. Each man became

afraid to take the tickets of another. Some declined to redeem their tickets in any way,

and some absconded. And people found out, as is always the case where there is a

redundancy of paper money, that they had been extravagant, had bought things they

did not need, and had run in debt for a larger amount than they were able to pay.

Of course, nearly everyone failed, and charged his failure upon President Jackson’s

specie circular. In after times, I asked an old settler, who was a great growler in

those days, what effect time had had upon his views of General Jackson’s circular.

His reply was that General Jackson had spoiled his being a great man. Said he, “I

came to Chicago with nothing, failed for $100,000, and could have failed for a million,

if he had left the bubble burst in the natural way.”

“Reiniscensces of Early Chicago”, The Lakeside Press, Chicago, 1912

Hyperinflation – the ultimate nightmare of currency depreciation.

The many parallels between 1924 Germany and present-day United States are

cause for concern. Though the U.S. has not yet reached the depths to which

Germany descended in that era, few can look at the constant depreciation of

the dollar since the early 1970’s and fail to be alarmed. It seems contemporary

America differs from 1924 Germany only in the duration between cause and effect.

While the German experience was compressed over a few short years, the effects

of the American inflation have been more drawn out.