Archive for April, 2010

China is undermining the dollar by the back-door

Over the past year since March 2009, the Federal Reserve not so quietly

engaged in a major printing effort (of 1.75 Trillion dollars), while

concealing the fact that this monetization was required to keep

US economy afloat.

They use the term of “quantitative easing” to mask the truth for the general

public. Quantitative easing is printing money out of thin air. They also

directed the printing presses toward bailing out very sick US mortgage

market (mostly MBS), although there was also explicit monetization of

treasuries.

Explicit monetization of US treasuries by the Fed is almost equivalent to

default. However, US credit rating agencies continue to rate US sovereign

debt as AAA (surprise!)

It appears China, the largest holder of US sovereign debt, is finally

starting to “get it”. If China is serious about De-pegging from US

dollar, as pressured by US authorities, then we may see US

dollar plunge. For now Chinese currency is pegged to US dollar,

thus, Chinese buying is determined by the peg. Read more in this article in FT.

China is undermining the dollar by the back-door

By Gerard Lyons

Published: April 27 2010 15:50 | Last updated: April 27 2010 15:50

There is a ticking time bomb under the dollar. When it explodes depends not just on the US economy

but also on policy actions in Beijing and Washington. Over the last year the Chinese have undermined

the dollar by the back-door, questioning it as a store of value and medium-of-exchange.Although the Chinese are not advocating the renminbi as the alternative to the dollar this may be only

a matter of time. One needs to focus on what the Chinese do, as well as listen to what they say. A key

development is China’s encouragement of international use of the renminbi, although they prefer to call it invoicing.This may be from a low starting point but one Chinese saying may be worth bearing in mind: “A march

of 10,000 miles begins with one small step”. Early signs are promising.China is encouraging exporters to invoice in the renminbi and is setting up systems to allow trade

payments in renminbi. This make sense. China’s trade is soaring. New trade corridors may soon

require new means of payment. When the Chinese and Brazilian Presidents met last

year they agreed to use their own currencies to settle more of their bilateral trade, rather than

invoicing in dollars. Although viewed as symbolic, it is a sign of things to come.……………..

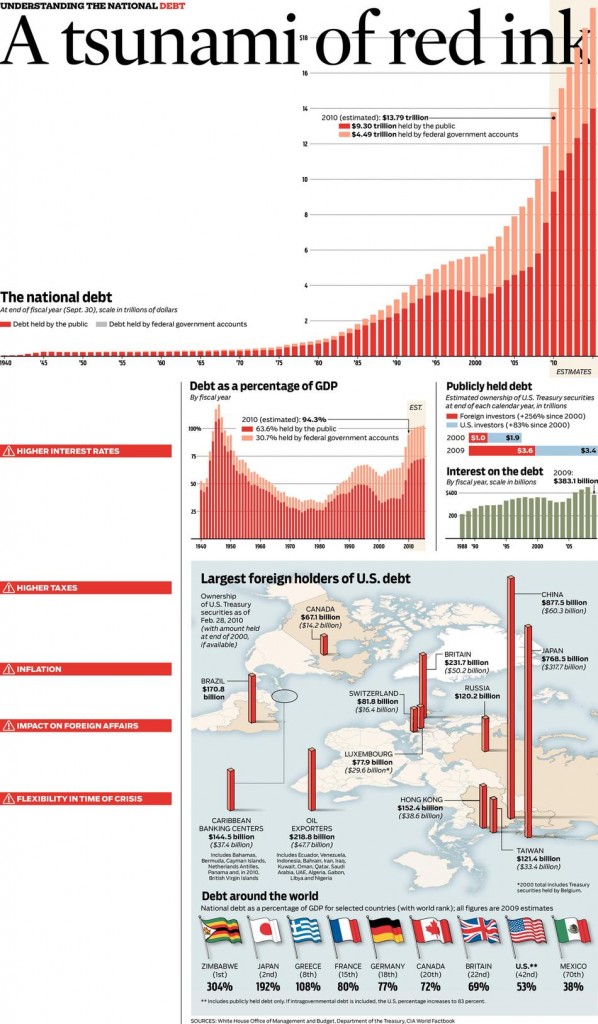

The horrible state of US national debt

US national debt

This picture is from the Chicago tribune

US national debt is a disaster in the making. Currently the demand for treasuries

is being artificially propped by US credit rating agencies that downgrade European

countries but keep their mouth shut about the fiscal position of the United States and

the States in the United States, such as California, which are much worse off than

Greece (in the EU).

Sovereign risk and derivative domino effect.

While this web site was originally devoted to unhealthy imbalances

in the United States, these are currently present all over the globe.

As we have seen lately, as sovereign debt issues surfaced in Greece,

CDS market rapidly started pricing sovereign risk higher in other PIIGS

(Portugal, Italy, Ireland, Greece, Spain), the UK, Germany, and the US.

These imbalances in an isolated country normally occur after a financial

crisis, when the government attempts a Keynesian approach to fight

the crisis. If the fight is unsuccessful, the government assumes too

much debt, while the economy does not recover, a currency crisis

will follow (Argentina 2002, East Asia 1997, Russia 1998, Iceland 2008,

etc.,etc.).

The financial crisis of 2008 was global in nature, and the Economist

has a wonderful discussion of what might follow if the global economy

does not recover due to too much debt. I believe this is coming –

perhaps, later in 2010 or in 2011, as a consequence of the global

financial crisis of 2008.

Sovereign-debt worries – the Economist.

Domino theory

Assessing the risk that Greece’s woes herald something far worse

HOW far is it from Athens to America and which

countries lie on the way? That may sound like an esoteric geography

question, but it is being asked by investors as Greece’s debt crisis

creates global jitters about the safety of sovereign debt. So far

Portugal, Ireland and Spain, the other high-deficit countries on the

periphery of the euro zone, are thought to be next in line. In most big

rich economies, yields have been stable and well below their long-term

average (see chart).But nerves are fraying elsewhere. The cost of insuring against

sovereign default (see article) has risen in 47 of the 50 countries for

which these instruments exist. Dubai’s sovereign credit-default-swap

spreads soared to their highest level in a year this week, amid concern

about the terms of a debt restructuring by a state-owned

conglomerate. There is increasingly shrill commentary arguing that

Greece is the start of a far bigger problem. “A Greek crisis is coming to

America”, blared the headline on a recent Financial Times article by

Niall Ferguson, a financial historian.The stakes are high. A sudden loss of confidence in all sovereign debt,

and especially in American Treasuries, the world’s benchmark “risk-free”

asset, would have calamitous consequences in a still-fragile recovery.

Equally, an exaggerated fear of sovereign risk could prompt

governments into premature fiscal austerity, which might itself push

the world economy back into recession…..