Archive for January, 2010

A message to CFTC – gaming the system will work no more.

CFTC recently engaged in a massive regulatory overhaul of the

commodity markets, targeting limited positions and increasing margins in commodities, in particular, in energy.

This affects exchange traded funds such as UNG (Natural Gas) and USO (oil). In their view, commodity speculators drove

oil and gas to unreasonable levels in the Summer of 2008, in part, triggering the current crisis.

While limited trading in any derivatives is a welcome step, this is, of course, ridiculous.

The run in commodities was triggered by the Fed drastically lowering interest rates and printing money to

save the literally huge derivative Ponzi scheme that our global financial system has become.

“Gaming” free markets is not the way to go. We did that for quite some time now, and that’s why

the financial crisis happened. The Free market broke free from all this derivative model manipulation

and this resulted in a Black Swan. As long as OTC derivative bubble is inflating further,

chances of another, deeper systemic crisis are increasing. If the current

policy of bailing out too big to fail counterparties continues, there is a chance the derivative

Ponzi scheme will eventually blow up and take down entire countries – including, possibly, USA.

Regulate what matters – OTC interest rate derivatives and credit derivatives!

John Embry of Sprott Asset Management on Fed’s options.

Essentially, the two choices for the Fed are not pretty –

hyperinflate or face a devastating deflationary collapse due

to mega-Ponzi derivative fiasco. The Fed chose hyperinflation.

“Any serious attempt to withdraw the stimulus at

this point will trigger a deflationary depression and

a continuation of the current policies will put us

firmly on the road to hyperinflation”

Inflation, Deflation, or a pure mess.

Do we have to worry about gold?

In my view, just buy physical gold and silver, GDX and GDXJ, and keep them. Gold

will go up. How much depends on policy actions. In particular, whether or not the

US government chooses to pursue very accomodative fiscal and monetary policy.

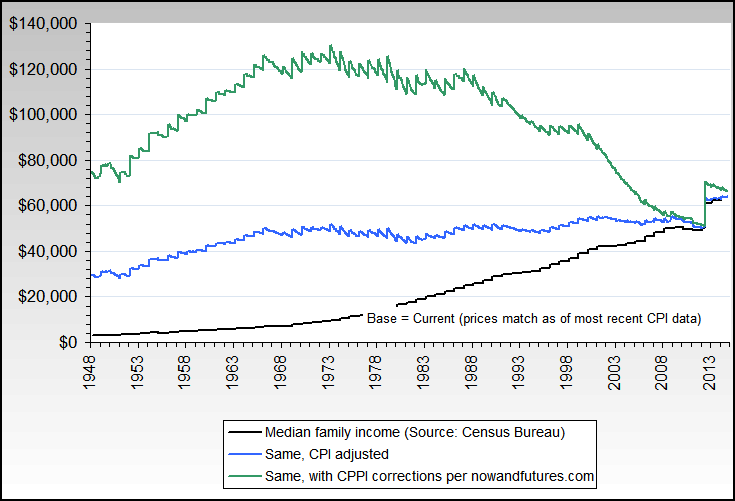

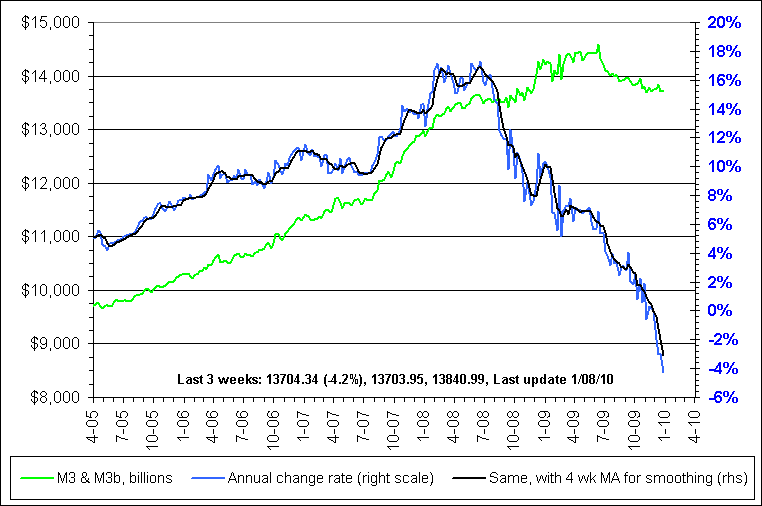

On the charts front, reconstructed M3 from Bart at nowandfutures.com and John

Williams at shadowstats.com shows a decline. However, inflation is picking up,

and the Fed printing so far is going ballistic.

The Fed emits tightening noises, but, given US employment situation, rates will

stay at Zero for a long time. The printing program will end in March, while the

government mortgage subsidy program ends in April. Then we will see how the economy

performs without direct money printing support, or what the Fed will do if it falters

again. This could be expected, since an enormous credit bubble popped in 2006-2008.

The danger of printing too much money…

The 1993-1994 hyperinflation episode in Yugoslavia has been the worst in modern history.

Between October 1, 1993 and January 24, 1995 prices increased by 5 quadrillion percent. That’s a 5 with 15 zeroes after it.

The Worst Episode of Hyperinflation in History: Yugoslavia 1993-94

Thayer Watkins, Ph.D.

1993 Yugoslav dinar banknote

Under Tito, Yugoslavia ran a budget deficit that was financed by printing money. This led to a rate of inflation of 15 to 25

percent per year. After Tito, the Communist Party pursued progressively more irrational economic policies. These policies and

the breakup of Yugoslavia (Yugoslavia now consists of only Serbia and Montenegro) led to heavier reliance upon printing or

otherwise creating money to finance the operation of the government and the socialist economy. This created the

hyperinflation.

By the early 1990s the government used up all of its own hard currency reserves and proceded to loot the hard currency

savings of private citizens. It did this by imposing more and more difficult restrictions on private citizens’ access to their hard

currency savings in government banks.

The government operated a network of stores at which goods were supposed to be available at artificially low prices. In

practice these store seldom had anything to sell and goods were only available at free markets where the prices were far

above the official prices that goods were supposed to sell at in government stores. All of the government gasoline stations

eventually were closed and gasoline was available only from roadside dealers whose operation consisted of a car parked with a

plastic can of gasoline sitting on the hood. The market price was the equivalent of $8 per gallon. Most car owners gave up

driving and relied upon public transportation. But the Belgrade transit authority (GSP) did not have the funds necessary for

keeping its fleet of 1200 buses operating. Instead it ran fewer than 500 buses. These buses were overcrowded and the ticket

collectors could not get aboard to collect fares. Thus GSP could not collect fares even though it was desperately short of

funds.

Delivery trucks, ambulances, fire trucks and garbage trucks were also short of fuel. The government announced that gasoline

would not be sold to farmers for fall harvests and planting.

Despite the government’s desperate printing of money it still did not have the funds to keep the infrastructure in operation.

Pot holes developed in the streets, elevators stopped functioning, and construction projects were closed down. The

unemployment rate exceeded 30 percent.

The government tried to counter the inflation by imposing price controls. But when inflation continued, the government price

controls made the price producers were getting so ridiculous low that they simply stopped producing. In October of 1993 the

bakers stopped making bread and Belgrade was without bread for a week. The slaughter houses refused to sell meat to the

state stores and this meant meat became unvailable for many sectors of the population. Other stores closed down for

inventory rather than sell their goods at the government mandated prices. When farmers refused to sell to the government at

the artificially low prices the government dictated, government irrationally used hard currency to buy food from foreign sources

rather than remove the price controls. The Ministry of Agriculture also risked creating a famine by selling farmers only 30

percent of the fuel they needed for planting and harvesting.

Later the government tried to curb inflation by requiring stores to file paperwork every time they raised a price. This meant

that many store employees had to devote their time to filling out these government forms. Instead of curbing inflation this

policy actually increased inflation because the stores tended to increase prices by larger increments so they would not have

file forms for another price increase so soon.

In October of 1993 they created a new currency unit. One new dinar was worth one million of the “old” dinars. In effect, the

government simply removed six zeroes from the paper money. This, of course, did not stop the inflation.

In November of 1993 the government postponed turning on the heat in the state apartment buildings in which most of the

population lived. The residents reacted to this by using electrical space heaters which were inefficient and overloaded the

electrical system. The government power company then had to order blackouts to conserve electricity.

In a large psychiatric hospital 87 patients died in November of 1994. The hospital had no heat, there was no food or medicine

and the patients were wandering around naked.

Between October 1, 1993 and January 24, 1995 prices increased by 5 quadrillion percent. This number is a 5 with 15 zeroes

after it. The social structure began to collapse. Thieves robbed hospitals and clinics of scarce pharmaceuticals and then sold

them in front of the same places they robbed. The railway workers went on strike and closed down Yugoslavia’s rail system.

The government set the level of pensions. The pensions were to be paid at the post office but the government did not give

the post offices enough funds to pay these pensions. The pensioners lined up in long lines outside the post office. When the

post office ran out of state funds to pay the pensions the employees would pay the next pensioner in line whatever money

they received when someone came in to mail a letter or package. With inflation being what it was, the value of the pension

would decrease drastically if the pensioners went home and came back the next day. So they waited in line knowing that the

value of their pension payment was decreasing with each minute they had to wait.

Many Yugoslavian businesses refused to take the Yugoslavian currency, and the German Deutsche Mark effectively became the

currency of Yugoslavia. But government organizations, government employees and pensioners still got paid in Yugoslavian

dinars so there was still an active exchange in dinars. On November 12, 1993 the exchange rate was 1 DM = 1 million new

dinars. Thirteen days later the exchange rate was 1 DM = 6.5 million new dinars and by the end of November it was 1 DM = 37

million new dinars.

At the beginning of December the bus workers went on strike because their pay for two weeks was equivalent to only 4 DM

when it cost a family of four 230 DM per month to live. By December 11th the exchange rate was 1 DM = 800 million and on

December 15th it was 1 DM = 3.7 billion new dinars. The average daily rate of inflation was nearly 100 percent. When farmers

selling in the free markets refused to sell food for Yugoslavian dinars the government closed down the free markets. On

December 29 the exchange rate was 1 DM = 950 billion new dinars.

About this time there occurred a tragic incident. As usual, pensioners were waiting in line. Someone passed by the line

carrying bags of groceries from the free market. Two pensioners got so upset at their situation and the sight of someone else

with groceries that they had heart attacks and died right there.

At the end of December the exchange rate was 1 DM = 3 trillion dinars and on January 4, 1994 it was 1 DM = 6 trillion dinars.

On January 6th the government declared that the German Deutsche was an official currency of Yugoslavia. About this time the

government announced a NEW “new” Dinar which was equal to 1 billion of the old “new” dinars. This meant that the exchange

rate was 1 DM = 6,000 new new Dinars. By January 11 the exchange rate had reached a level of 1 DM = 80,000 new new

Dinars. On January 13th the rate was 1 DM = 700,000 new new Dinars and six days later it was 1 DM = 10 million new new

Dinars.

The telephone bills for the government operated phone system were collected by the postmen. People postponed paying these

bills as much as possible and inflation reduced their real value to next to nothing. One postman found that after trying to

collect on 780 phone bills he got nothing so the next day he stayed home and paid all of the phone bills himself for the

equivalent of a few American pennies.

Here is another illustration of the irrationality of the government’s policies: James Lyon, a journalist, made twenty hours of

international telephone calls from Belgrade in December of 1993. The bill for these calls was 1000 new new dinars and it arrived

on January 11th. At the exchange rate for January 11th of 1 DM = 150,000 dinars it would have cost less than one German

pfennig to pay the bill. But the bill was not due until January 17th and by that time the exchange rate reached 1 DM = 30

million dinars. Yet the free market value of those twenty hours of international telephone calls was about $5,000. So despite

being strapped for hard currency, the government gave James Lyon $5,000 worth of phone calls essentially for nothing.

It was against the law to refuse to accept personal checks. Some people wrote personal checks knowing that in the few days

it took for the checks to clear, inflation would wipe out as much as 90 percent of the cost of covering those checks.

On January 24, 1994 the government introduced the “super” Dinar equal to 10 million of the new new Dinars. The Yugoslav

government’s official position was that the hyperinflation occurred “because of the unjustly implemented sanctions against the

Serbian people and state.”

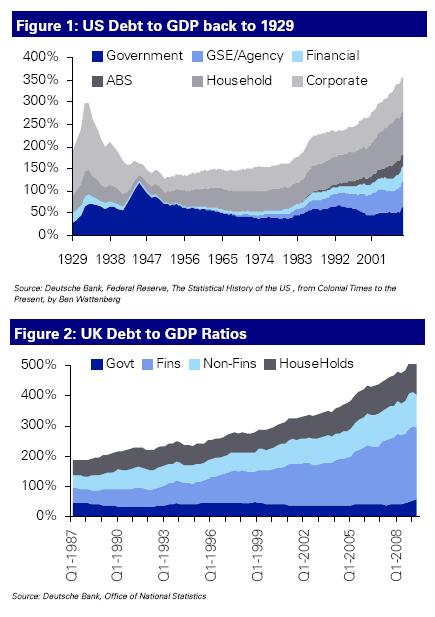

Deutsche Bank 2010 investment outlook – sovereign debt.

Here’s what the Deutsche team, led by Jim Reid, say:

Although we’re positive in the near-term, looking at the world today it’s clear that the current macro environment will be

difficult to sustain. The markets will need evidence in 2010 that there is an observable path back to fiscal discipline for those

countries that have been most aggressive in responding to the fall-out from this crisis. If not we continue to run the risk of

Sovereign land mines disturbing the benign corporate landscape.Indeed if 2010 is a difficult year it’s highly unlikely that the catalyst comes from within the equity or corporate credit markets.

This means the macro environment will decide 2010, and in reality investors in Sovereign debt around the world will probably

decide the fate of risk assets. In late 08/09 the authorities had little to lose in aggressively attempting to stave off a

Depressionary cycle. So far they deserve extremely high marks. However 2010 could be a transitional year between heavy

intervention and the paying of the bills. A return to positive global growth should help but we would expect more volatility in

2010 than in H2 2009.Back to Sovereign risk, history is littered with examples of inflation, devaluations and Sovereign defaults after financial crisis.

One might wonder why this time should be any different. Sustainability is the key word. As soon as markets doubt the

sustainability of a country’s deficit then we have a problem. This is why it’s important that in 2010 the authorities provide a

credible path for future fiscal discipline, even this path involves many years of adjustments. One of the largest challenges will

be funding the still large global government issuance in a world with less QE. QE limited the discussion on the impact of

crowding out in 2009. Will we be as fortunate in 2010?Deutsche Bank has the following scenarios:

Scenario 1 — This scenario is the most optimistic and is one where the authorities have as good a year as they did in 2009.

They likely keep stimulus extremely high in the system without there being any noticeable consequences of their actions (e.g.

rates at the short and long-end stay low). Under this scenario we would expect equities to be significantly higher, credit

spreads be much tighter but with bond yields only edging slightly higher as the authorities are seen to have firm control of

inflation expectations and may even be continuing to buy bonds.Scenario 2 – This scenario is the most likely and suggests that we start to see gradual easing off the gas from the authorities

but only as it’s proved that there is some momentum in the underlying economy. Under this scenario risk assets have a good

year but returns are checked to some degree by rising bond yields and less stimulus being injected into markets. A satisfactory

year for risk, especially equities, but a mildly negative one for fixed income. Credit investors will likely have to rely on spreads

(and higher beta credit) to get positive total returns.Scenario 3 – This is the second most likely scenario overall in 2010 but one that potentially becomes more likely as the year

progresses. Here we are likely to see sharply higher bond yields start to disrupt the positive momentum in markets. These

higher yields could be either due to Government supply starting to overwhelm demand (especially as the impact of QE, and

similar schemes, wane), or because of inflation fears. It seems unlikely that actual inflation will be a concern in 2010 but it’s

quite possible for expectations to become unanchored. We would also have to include the potential for a Sovereign crisis

somewhere in the Developed world within this scenario. We would note that the higher yields in this scenario are not based on

positive growth momentum but by inflation/Sovereign risk. Such a scenario is incorporated in Scenario 2.Scenario 4 — This is the nightmare scenario of Deflation or in less extreme terms perhaps a double-dip. Given that much of the

world is currently still in negative YoY inflation territory it is difficult to completely rule out even if we do live in a fiat currency

system and even if inflation is expected to return to positive territory in early 2010. For deflation to be sustained we would

probably need an exogenous event to hamper the authorities ability to continue to successfully fight this credit crisis. Such

events could be a fresh banking crisis arising, a political backlash encouraging immediate increases in 2 December 2009 Macro

Credit and Equity Page 4 Deutsche Bank AG/London economic regulation or withdrawal of stimulus, or possibly a Government

bond/currency sell-off that forces the authorities to aggressively reign in stimulus for fear of a sovereign crisis. A Sovereign

crisis outside the Developed world could also encourage this scenario as there would be a flight to quality into Developed

market bond market in spite of the fact that these markets have their own large fiscal issues. Bond yields would eventually rally

strongly but risk assets would experience a very poor year. As time progresses this scenario becomes less likely as the system

gradually repairs itself and the authorities are allowed more time to inflate the global economy. As we discuss in scenario 3, the

more likely risk scenario is inflation, especially as time progresses.We have tried to simplify and narrow down the scenarios as much as possible to allow for easy explanation but the reality is

that there are many other permutations for the year ahead. For example and as discussed above, within the worst case

scenario we would have to include a slightly less severe outcome where growth fails to show any momentum after the stimulus

starts to fade (a double dip perhaps?). If the authorities are unwilling or unable to stimulate further then we could have a weak

economy even if we don’t see outright deflation. This would likely be negative for equities/credit but the outcome would be

unlikely to be as negative as the -30% outcome.The other big problem in differentiating between the two negative scenarios is with regards to Sovereign risk. If we have

Sovereign risk within the EM complex (e.g. Dubai) then Western bond yields could rally strongly on a flight to quality basis. So

an element of this risk is priced into Scenario 4. However we are in a fairly unusual point in history where there is also an

increasing risk of a Sovereign crisis occurring in the Developed world at some point. The fiscal deficits arising from this crisis

have to be addressed at some point. If the market eventually sees no credible medium-term way of certain Western countries

balancing their budgets and repaying their debts then we may see a large rise in Government yields. This in itself could be

enough to raise funding costs to levels that encourage a vicious circle.Figure 1 and Figure 2 help us understand why we are entering into unknown territory in terms of Developed market debt. These

charts simply show the Debt to GDP ratio of the US and the UK. The Government part of the deficit is starting to rise sharply in

both regions and although it looks within the range of historic observations we have to remember that Governments have

implicitly and explicitly backed the debt of other parts of the economy. This makes Government liabilities potentially much

larger. The hope is that growth rebounds strongly enough for the Debt/GDP ratio to fall naturally over time. Such a scenario

would also require yields to stay low to facilitate such an adjustment. All we can say is that there are risks that the deficits of

such indebted countries at some point appear unsustainable to the market. This is when far more difficult decisions than those

made in 2009 would have to be made.

US and UK debt to GDP ratio

Pimco Favors Bonds of Germany to U.S.

Investors should favor government bonds in countries with strong fiscal positions, such as Germany, this year, and prepare for a

tougher year in the U.S. and the U.K. in particular, where interest rates will rise as governments and central banks start to

withdraw their huge stimulus efforts, according to Bill Gross, co-chief investment officer at bond fund giant Pimco.

Pimco Favors Bonds of Germany to U.S.

Bill Gross, January 2010 Pimco investment outlook.

Distressed as I am about the state of American democracy, a rational money manager cannot afford to get mad or “just get even” when it comes to investing clients’ money. Still, like pilots politely advertise at the end of most flights, “We know you have a choice of airlines and we thank you for flying ‘United’.” Global investment managers likewise have a choice of sovereign credits and risk assets where stable inflation and fiscal conservatism are available. If 2008 was the year of financial crisis and 2009 the year of healing via monetary and fiscal stimulus packages, then 2010 appears likely to be the year of “exit strategies,” during which investors should consider economic fundamentals and asset markets that will soon be priced in a world less dominated by the government sector. If, in 2009, PIMCO recommended shaking hands with the government, we now ponder “which” government, and caution that the days of carefree check writing leading to debt issuance without limit or interest rate consequences may be numbered for all countries.

Derivatives – a disaster we avoided or a disaster in the making?

I have quite a few quant friends (and family) who are occupied in derivatives.

They know very well how to run stochastics and

Monte Carlo codes to price these complex instruments, but are unaware of

more pressing issues, such as why this huge Ponzi scheme caused a market

crash in 2008, why such enormous bailouts around the globe were required

to save it. Unfortunately, the repeated bailouts and saves by the global

central banks only provided liquidity to this Ponzi scheme and fostered further

expansion, pretty much ensuring another financial crisis in the future. The first time

derivatives caused a crash was 1987, when portfolio insurance (or put options, in

modern equivalent) caused a meltdown due to hedging as the market fell through

put strikes. Of course, quants say they were not perfect, since implied volatility was

then flat.

Here is what Myron Scholes has to say on the subject, and I totally agree. I would add,

blow up not just OTC CDS market, but all of it. Scholes knows. Not only he is the Nobel

Laureate and the father of Black-Scholes, he also ran LTCM that blew up for the very

same reason in 1998. Cancelling contracts while things are good seems to be an

excellent option. The reason for a complete seizure of the libor market was the

market pricing of couterparty risk. It happened before, and it can happen again.

The notional size of derivatives market is 10 times the size of the global GDP,

and the usual Central bank liquidity fix will only make it bigger.

Myron Scholes, intellectual godfather of the credit default swap, says blow ’em all up

Myron Scholes, whose Black-Scholes option pricing model provided the intellectual underpinning for modern derivatives markets, thinks one particular derivatives market—that for credit default swaps—is due for a Red Adair style rescue. Or a Fred Adair style rescue.

Red Adair put out oil well fires by setting off gigantic explosions at the wellhead. “My belief is that the Fred Adair solution is to blow up or burn the OTC market in credit default swaps,” Scholes said this morning. What that means, he elaborated, is that regulators should “try to close all contracts at mid-market prices” and then start up the market anew with clearer rules and shorter-duration contracts.

This was at a conference at New York University occasioned by a new collection of papers on how to fix the financial system, authored by a bunch of NYU Stern School faculty. Scholes kept saying Fred Adair. Sometimes he’d notice and correct himself, sometimes he wouldn’t. The FT’s John Gapper, who was on a panel with Scholes, finally speculated that this was because the government response to the financial crisis has been such an unwieldy mix of Fred Astaire (dancing around the problems) and Red Adair (doing something to fix them). Scholes did not disagree.

The blow-up-the-CDSes option is intriguing, and I’m going to check in with Scholes later to see if he wishes to elaborate. But for now, a few more notes from the panel, which was moderated by Paul Volcker and also featured NYU finance professor Matt Richardson:

Some would say Scholes is partly to blame for this whole mess, and Volcker dropped a couple of hints in that direction. Scholes didn’t exactly accept responsibility, but neither did he give a blindered, Chicago-style defense. For one thing, he cited John Maynard Keynes—still a nonperson to many of Scholes’s fellow Chicago Ph.Ds—arguing that we’re currently stuck in a situation where the financial system needs to deleverage, but its current deleveraging is causing asset values to plummet, meaning that it’s not succeeding in deleveraging at all (that is, debt is down, but so is the value of everybody’s capital, so leverage ratios aren’t declining). For another, he seemed to agree with one of the main criticisms of the Wall Street risk models that evolved in part from Black-Scholes—that they have some ability to capture the risks faced by one investor operating in a financial market that the investor is too small to influence, but aren’t much good at capturing the risks faced by the entire market. “Risk aggregation is not linear,” he said. “It’s nonlinear.” (This is what Chapter 13 of The Myth of the Rational Market is about. Doesn’t that sound exciting?)

As the moderator, Volcker didn’t say all that much. He did talk for a bit, though, about how “maybe we ought to have a two-tier financial system,” with a heavily regulated “core part that I will for purposes of simplicity call commercial banking” and a less-regulated outer realm of hedge funds, proprietary trading desks, and such. Hmmm, said Gapper, that “reminds me of something I once heard of called the Glass-Steagall Act.” This Glass-Steagall revivalism is happening all over. I’m even beginning to feel the spirit. But Gapper had an interesting question: “If you wanted to set up a new Glass-Steagall, where would you draw the line?”

Scholes finally got his free-market Chicago dander up over the possibility of synchronized global financial regulation—something that Volcker has been advocating as chairman of the Group of Thirty project on financial reform—sparking this entertaining exchange:

Scholes: If we internationalize everything, we end up with rules that stifle freedom and innovation. Mr. Sarkozy and others say our system has failed and we should adopt theirs. Do we want to become French?

Volcker: I’m not an acolyte of Mr. Sarkozy.

Gapper: Actually, the French banks are big derivatives users.

Volcker: The U.S. is no longer in a position to dictate to the rest of the world.

US standard of living is dropping

The crisis didn’t start last year, it was building up for some time.

The real reason was not the housing bubble. Yes, housing prices soared due to

Greenspan’s ultra easy monetary policy in the early 2000-s,

but, in fact, in gold terms they are quite average historically, as of late 2009/early 2010.

The real problem was falling US standard of living, and that has been happening for some time,

as seen on these charts below. The falling standard of living is a direct consequence of

the falling currency.