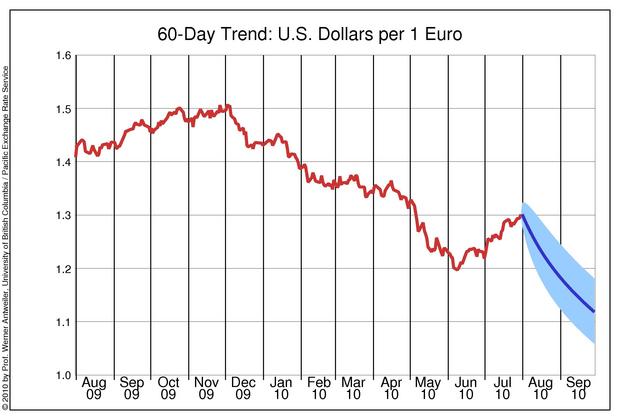

Euro/US dollar pair and SP500

The recent bounce of the Euro led directly to a sharp drop of the dollar index.

This was, perhaps, in part due to the ECB country bailout measures, in part due

to the talk of new Quantitative Easing measures (money printing) by US Federal reserve

due to commence soon. There was much talk, but so far no action, which leaves the

trap door open for a possible disappointment in mid-August, since the Euro

got very overbought. The 60-day regression analysis for Euro/US dollar pair

from UBC is shown below.

This was bullish for equities. A quick note here that the convergence target

for SP500 with inverse USD index moved much higher, to about SP500=900.

No comments yet.

Leave a comment

You must be logged in to post a comment.