Deutsche Bank 2010 investment outlook – sovereign debt.

Here’s what the Deutsche team, led by Jim Reid, say:

Although we’re positive in the near-term, looking at the world today it’s clear that the current macro environment will be

difficult to sustain. The markets will need evidence in 2010 that there is an observable path back to fiscal discipline for those

countries that have been most aggressive in responding to the fall-out from this crisis. If not we continue to run the risk of

Sovereign land mines disturbing the benign corporate landscape.Indeed if 2010 is a difficult year it’s highly unlikely that the catalyst comes from within the equity or corporate credit markets.

This means the macro environment will decide 2010, and in reality investors in Sovereign debt around the world will probably

decide the fate of risk assets. In late 08/09 the authorities had little to lose in aggressively attempting to stave off a

Depressionary cycle. So far they deserve extremely high marks. However 2010 could be a transitional year between heavy

intervention and the paying of the bills. A return to positive global growth should help but we would expect more volatility in

2010 than in H2 2009.Back to Sovereign risk, history is littered with examples of inflation, devaluations and Sovereign defaults after financial crisis.

One might wonder why this time should be any different. Sustainability is the key word. As soon as markets doubt the

sustainability of a country’s deficit then we have a problem. This is why it’s important that in 2010 the authorities provide a

credible path for future fiscal discipline, even this path involves many years of adjustments. One of the largest challenges will

be funding the still large global government issuance in a world with less QE. QE limited the discussion on the impact of

crowding out in 2009. Will we be as fortunate in 2010?Deutsche Bank has the following scenarios:

Scenario 1 — This scenario is the most optimistic and is one where the authorities have as good a year as they did in 2009.

They likely keep stimulus extremely high in the system without there being any noticeable consequences of their actions (e.g.

rates at the short and long-end stay low). Under this scenario we would expect equities to be significantly higher, credit

spreads be much tighter but with bond yields only edging slightly higher as the authorities are seen to have firm control of

inflation expectations and may even be continuing to buy bonds.Scenario 2 – This scenario is the most likely and suggests that we start to see gradual easing off the gas from the authorities

but only as it’s proved that there is some momentum in the underlying economy. Under this scenario risk assets have a good

year but returns are checked to some degree by rising bond yields and less stimulus being injected into markets. A satisfactory

year for risk, especially equities, but a mildly negative one for fixed income. Credit investors will likely have to rely on spreads

(and higher beta credit) to get positive total returns.Scenario 3 – This is the second most likely scenario overall in 2010 but one that potentially becomes more likely as the year

progresses. Here we are likely to see sharply higher bond yields start to disrupt the positive momentum in markets. These

higher yields could be either due to Government supply starting to overwhelm demand (especially as the impact of QE, and

similar schemes, wane), or because of inflation fears. It seems unlikely that actual inflation will be a concern in 2010 but it’s

quite possible for expectations to become unanchored. We would also have to include the potential for a Sovereign crisis

somewhere in the Developed world within this scenario. We would note that the higher yields in this scenario are not based on

positive growth momentum but by inflation/Sovereign risk. Such a scenario is incorporated in Scenario 2.Scenario 4 — This is the nightmare scenario of Deflation or in less extreme terms perhaps a double-dip. Given that much of the

world is currently still in negative YoY inflation territory it is difficult to completely rule out even if we do live in a fiat currency

system and even if inflation is expected to return to positive territory in early 2010. For deflation to be sustained we would

probably need an exogenous event to hamper the authorities ability to continue to successfully fight this credit crisis. Such

events could be a fresh banking crisis arising, a political backlash encouraging immediate increases in 2 December 2009 Macro

Credit and Equity Page 4 Deutsche Bank AG/London economic regulation or withdrawal of stimulus, or possibly a Government

bond/currency sell-off that forces the authorities to aggressively reign in stimulus for fear of a sovereign crisis. A Sovereign

crisis outside the Developed world could also encourage this scenario as there would be a flight to quality into Developed

market bond market in spite of the fact that these markets have their own large fiscal issues. Bond yields would eventually rally

strongly but risk assets would experience a very poor year. As time progresses this scenario becomes less likely as the system

gradually repairs itself and the authorities are allowed more time to inflate the global economy. As we discuss in scenario 3, the

more likely risk scenario is inflation, especially as time progresses.We have tried to simplify and narrow down the scenarios as much as possible to allow for easy explanation but the reality is

that there are many other permutations for the year ahead. For example and as discussed above, within the worst case

scenario we would have to include a slightly less severe outcome where growth fails to show any momentum after the stimulus

starts to fade (a double dip perhaps?). If the authorities are unwilling or unable to stimulate further then we could have a weak

economy even if we don’t see outright deflation. This would likely be negative for equities/credit but the outcome would be

unlikely to be as negative as the -30% outcome.The other big problem in differentiating between the two negative scenarios is with regards to Sovereign risk. If we have

Sovereign risk within the EM complex (e.g. Dubai) then Western bond yields could rally strongly on a flight to quality basis. So

an element of this risk is priced into Scenario 4. However we are in a fairly unusual point in history where there is also an

increasing risk of a Sovereign crisis occurring in the Developed world at some point. The fiscal deficits arising from this crisis

have to be addressed at some point. If the market eventually sees no credible medium-term way of certain Western countries

balancing their budgets and repaying their debts then we may see a large rise in Government yields. This in itself could be

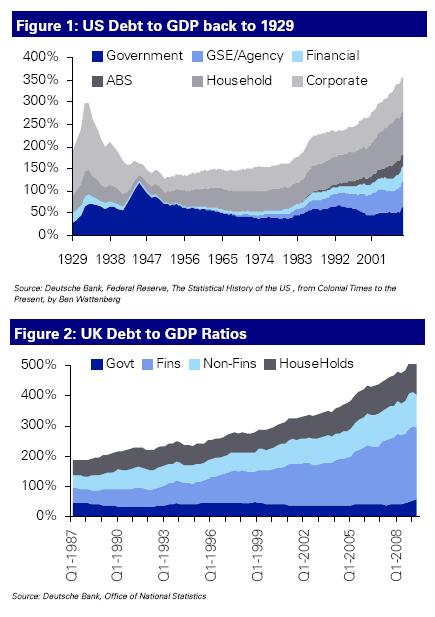

enough to raise funding costs to levels that encourage a vicious circle.Figure 1 and Figure 2 help us understand why we are entering into unknown territory in terms of Developed market debt. These

charts simply show the Debt to GDP ratio of the US and the UK. The Government part of the deficit is starting to rise sharply in

both regions and although it looks within the range of historic observations we have to remember that Governments have

implicitly and explicitly backed the debt of other parts of the economy. This makes Government liabilities potentially much

larger. The hope is that growth rebounds strongly enough for the Debt/GDP ratio to fall naturally over time. Such a scenario

would also require yields to stay low to facilitate such an adjustment. All we can say is that there are risks that the deficits of

such indebted countries at some point appear unsustainable to the market. This is when far more difficult decisions than those

made in 2009 would have to be made.

US and UK debt to GDP ratio

No comments yet.

Leave a comment

You must be logged in to post a comment.